Development and Sustainability at BIO

The private sector is crucial to achieving long-term, inclusive, and sustainable economic growth. It is responsible for over 90% of jobs in developing countries as well as for local value added, innovation, the provision of valuable goods and services, and tax revenue.

When looking at creating positive impact, the private sector is key in realising the Sustainable Development Goals by 2030 and actively contributes to mitigating poverty and reducing inequalities.

DFIs aim to create a strong, transformative, and responsible economy, mostly by working with investment capital.

DFIs play a significant role in supporting the private sector in developing countries. They aim to create a strong, transformative, and responsible economy, mostly by working with investment capital.

DFIs support the creation of profitable and sustainable businesses that also have a positive impact on society. While DFIs vary in governance, and in their sectoral and regional focus, they are all government-backed and, as such, they can take more risks and adopt a longer-term perspective.

DFIs strategically invest in locations and sectors that are considered risky and where conventional investors hesitate to tread. Leading by example, DFIs possess a catalytic effect, mobilising capital from more traditional private investors.

In summary, DFIs are investors who prioritise development impact over financial returns.

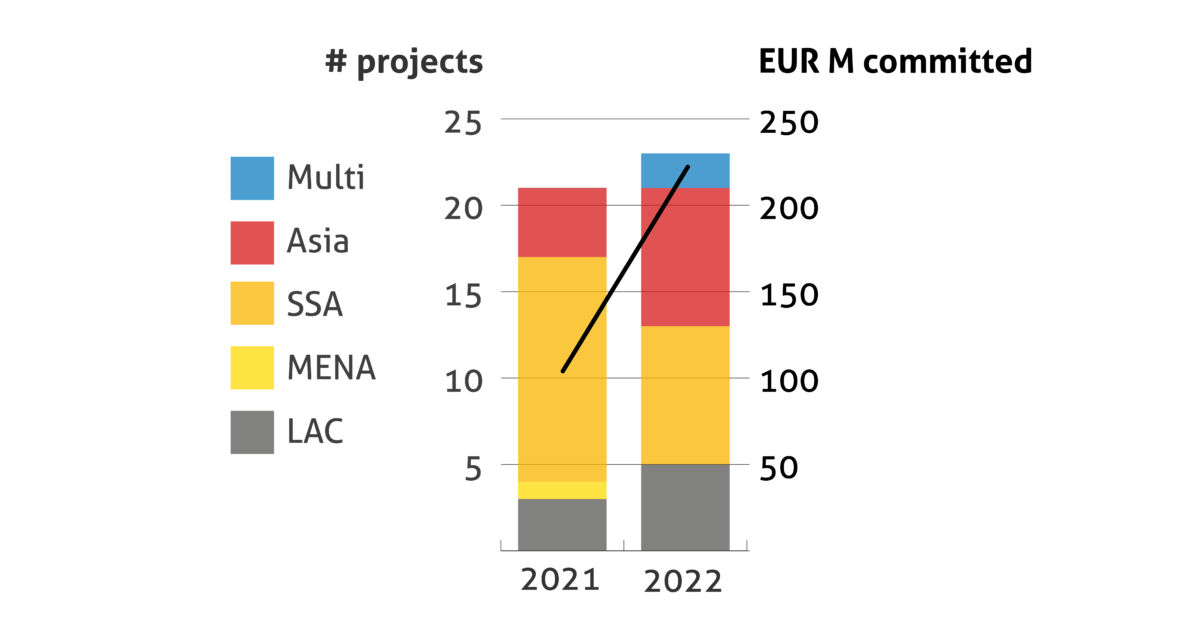

Evolution of new commitments

In 2022, BIO committed to provide funding for EUR 225 M in funding for 23 projects, most of which in sub-Saharan Africa and Asia. This represents an increase of about 10% in the number of projects but a more than doubled committed amount with respect to 2021. The geographic distribution of new projects focuses on sub-Saharan Africa and Asia, followed by Latin America and the Caribbean, and multi-regional projects.

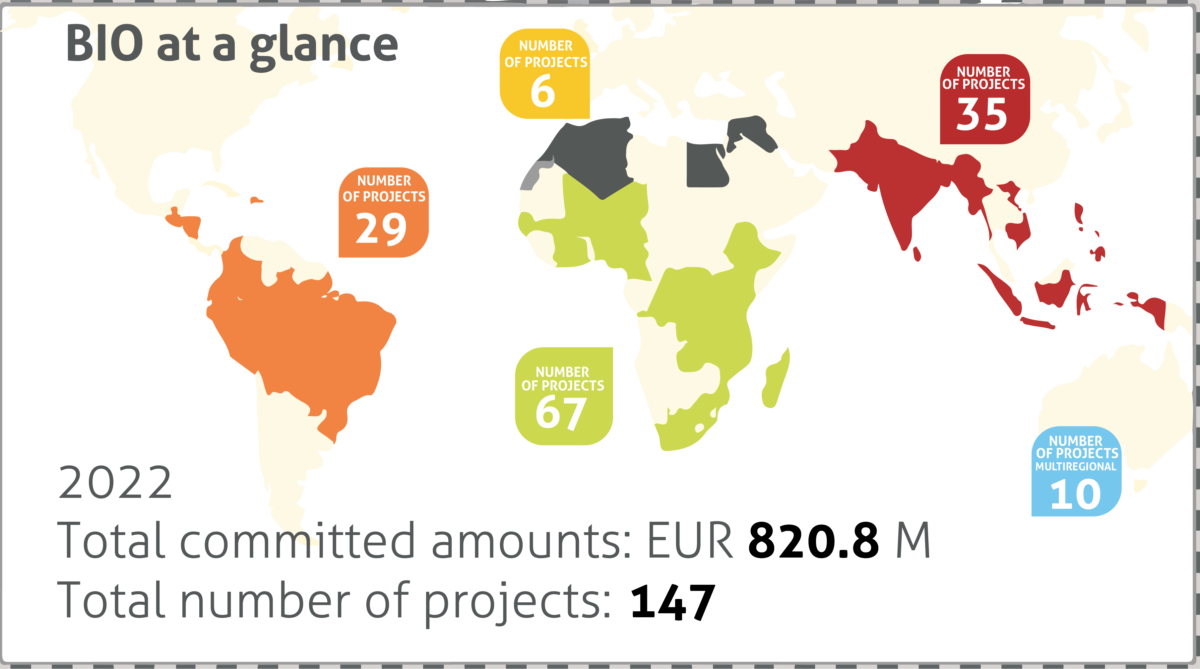

The Belgian Investment Company for Developing Countries is Belgium’s DFI. It is fully owned by the Belgian State as a central instrument to advance its development cooperation objectives and principles. By investing in private enterprises that are (likely) to be(come) vulnerable to sustainable development issues, and by primarily focusing on micro, small, and medium-sized enterprises (MSMEs), BIO actively contributes to promoting sustainable human development in low- and middle-income countries.

Working hard to achieve maximum development impact, BIO assesses in which domains – gender, decent work, the fight against climate change, the promotion of basic services to the population, etc. – an investment project has high development potential. BIO then collaborates closely with sponsors to prioritise these aspects during project implementation.

It carefully assesses a client’s potential economic, social, and environmental challenges and proposes measures to mitigate these risks, with clear milestones for improvements over time. Additionally, BIO offers expert advice and technical assistance to enhance business management, performance, sustainability, and overall development effectiveness of its projects.

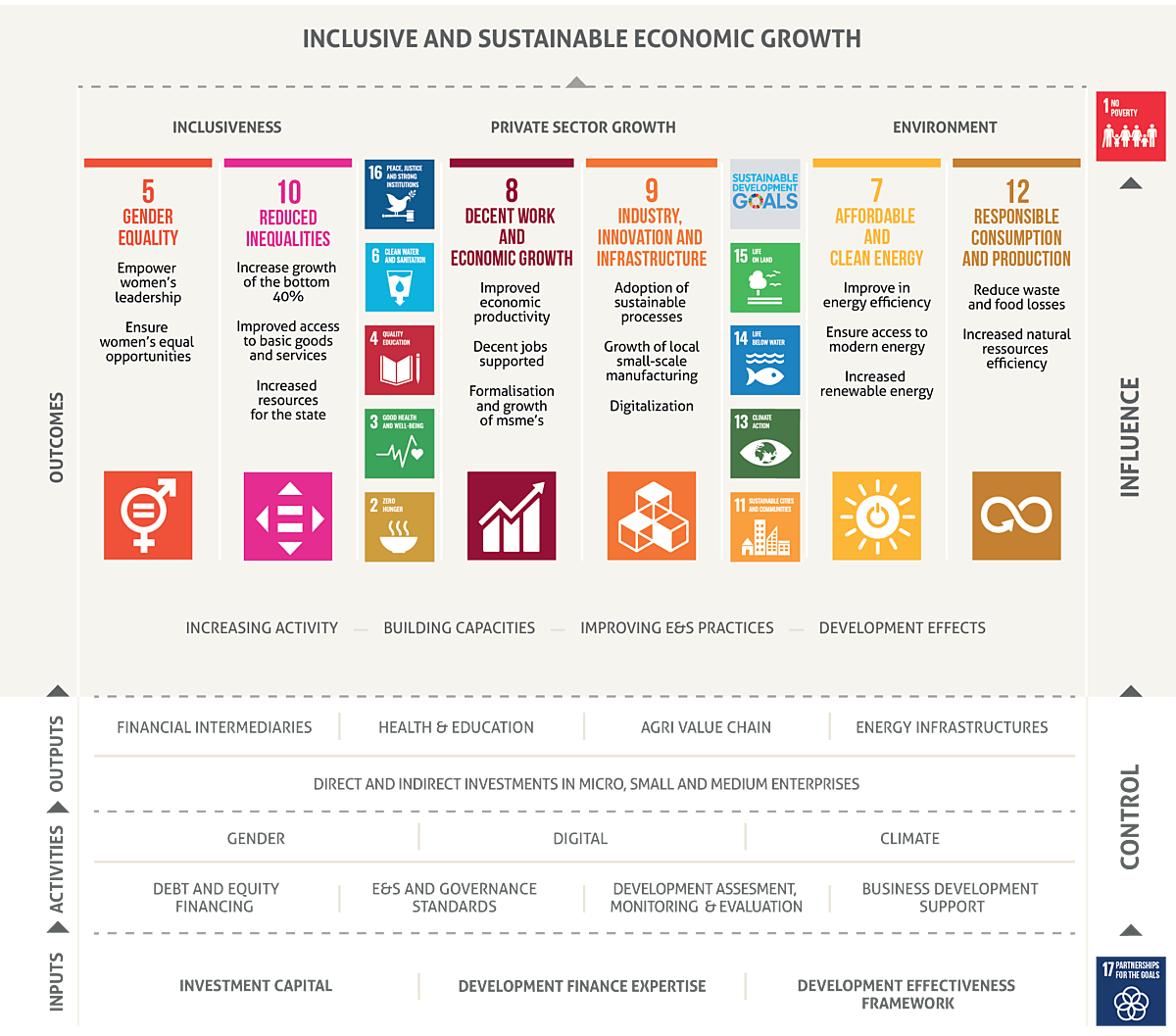

Since its establishment in 2001, BIO has diligently undertaken the task of assessing, monitoring, and evaluating the developmental outcomes of its portfolio companies. At the heart of this endeavour lies BIO's Theory of Change (ToC), a framework that aids in comprehending the true impact of its investments. This ToC offers an integrated approach, encompassing economic, social, and environmental development facets, while aligning strategically with six SDGs where BIO can wield its greatest influence.

The ToC also includes a set of key performance metrics that aim to capture BIO's significant contributions to each of the identified SDGs. In turn, BIO's Development Assessment, Monitoring, and Evaluation framework employs this ToC as a guide to measure its development impact.

This process of impact measurement and sustainability practices undergoes continual harmonisation with other European DFIs and impact investors. Through a structured, tangible, and transparent approach, this report illustrates BIO's contribution to the 2030 agenda, serving as a testament to BIO's commitment, not only to its investee companies but also to the Belgian State, the development community, civil society, and the wider public, all of whom are stakeholders in this pursuit.

Theory of Change and the SDGs

BIO’s Theory of Change provides a comprehensive description of its contribution to the 2030 agenda. Although the SDGs are not perfect and are sometimes difficult to quantify, they are the reference and guidance for BIO’s development mission because they represent the global agreement on what we all strive for in terms of a better world for all.

BIO’s ToC outlines the links between inputs, outputs, outcomes, and (expected) development impacts. It uses this framework to develop sustainable entrepreneurship in developing countries and to contribute to a world without poverty, where economic growth is inclusive and jobs are sustainable, in line with SDG1. BIO’s clients are expected to contribute to a number of SDGs. They can reduce gender inequalities (SDG5), provide affordable and clean energy (SDG7), create decent work and economic growth (SDG8), build innovative industries and infrastructure (SDG9), work on social inclusion (SDG10), or practise good environmental standards for responsible production and consumption (SDG12). These are priority goals for BIO and sustain most of BIO’s activities and departments. Other SDGs may also be relevant to BIO and its clients, but are dealt with more indirectly. For instance, the various projects in the agricultural sector contribute to SDG2. More transversally, by supporting climate change mitigation and adaptation, BIO contributes to SDG13. In addition, by ensuring that clients comply with BIO’s E&S policy, it also contributes to good health and wellbeing (SDG3), to the protection of the oceans and marine resources (SDG14), and to the conservation and sustainable use of terrestrial and other ecosystems (SDG15).

About OPIM

BIO is a signatory to the Operating Principles for Impact Management (OPIM). This is a framework to ensure that impact considerations are integrated throughout the investment lifecycle. The principles draw on emerging best practices from a range of asset managers, asset owners, asset allocators, and development finance institutions. Mid-2023 OPIM had 176 signatories from 39 countries and covered total assets of USD 516,400 M.

BIO forges valuable partnerships with its fellow European Development Finance Institutions through EDFI. It actively collaborates with other influential development actors, such as the Belgian development agency, Enabel, and mobilises funds from the private sector (SDG17), amongst others through the SDG Frontier Fund.

The SDG Frontier Fund is a closed-end, self-managed private equity fund of funds, focusing on SMEs across sectors in frontier markets of Africa and Asia in order to promote job creation and sustainable economic growth. In 2022, the fund reached its final closing for a total fund size of EUR 36 M, thanks to the participation of four additional Belgian private investors, including Ghent University and Ethias. The Fund aims to invest in 10 to 12 funds, which in turn will each invest in half a dozen to a dozen local small and medium-sized enterprises. In this way, more than a hundred SMEs will receive support. Three years after its creation, the SDG Frontier Fund already participates in ten funds active in Asia and Africa.

- Development ex ante Assessment Tool – As part of the due diligence, the tool allows to structure and document the development rationale of a given investment project, its contribution to the 8 BIO development goals (BDGs), and its financial and non-financial additionality. The potential on certain strategic, cross-cutting topics like gender or climate is also assessed.

- Monitoring Tool – Yearly monitoring of key development metrics (pre-defined set of indicators reflecting the envisaged development goals) for all portfolio projects – and Joint Impact Model (JIM) – Economic modelling to assess indirect effects.

- External Case Study Evaluation (ECSE) – Annual independent in-depth development effectiveness evaluation of a sample of ongoing or exited projects.

- Project Completion Tool – Ex post review and summary of a project’s main achievements (including business, finance, development, and E&S) and key lessons learnt that will be used to improve operational and strategic investment decisions, as well as operational processes.

While there is some interdependence between these, each tool follows its own procedure and addresses specific needs at different stages of the investment process.

The toolset is regularly updated to ensure continuous improvements in the fitness for purpose of the AME framework.

All investments by BIO and the SDG Frontier Fund pass through a similar cycle. Upon identifying a potential investment opportunity, BIO thoroughly assesses its alignment with the overarching investment strategy and its adherence to the prescribed investment conditions. If the criteria are met, a comprehensive due diligence exercise ensues, scrutinizing the project's governance, commercial viability, and financial aspects.

BIO also identifies environmental and social risks and opportunities, working closely with its clients to unlock the full development potential of the project. This crucial development aspect is thoroughly discussed from the outset, ensuring a shared vision between BIO and its investees.

Together, BIO and its investees establish a clear understanding of the expected development impacts, identifying areas where technical assistance may be required to bolster the project's success. Moreover, a concerted effort is made to create value not only for the company itself but also for its workforce and stakeholders, fostering a holistic approach to sustainable and impactful investment.

About JIM

Using input data such as revenue and power production from portfolio investments, the Joint Impact Model enables to estimate financial flows through the economy and its resulting economic (value added), social (employment), and environmental (greenhouse gas emissions) impact. These estimates can be used to measure and report on the contribution of individual institutions to the UN Sustainable Development Goals and the Paris Agreement.

The JIM is characterised by its harmonised and transparent methodology and assumptions, public availability, collaborative nature, up-to-date macroeconomic statistics, security features and user operated style.

About ECSE

The External Case Study Evaluation is an annual independent, thorough assessment of a sample of ongoing or completed projects, carried out to explore the developmental effectiveness of BIO's interventions. This evaluation typically centres on a specific theme, sector, or region, and uses desk research, surveys, interviews, extensive field visits, and reality checks to ensure comprehensive and accurate assessments.

In 2022, the external evaluation focused on BIO’s contribution to reducing inequalities, while in 2023, it will assess how BIO promotes decent work for all.

The IFC Performance Standards are the key reference when assessing BIO’s clients’ E&S performance. They cover a comprehensive array of environmental, social, and human rights topics. Each standard describes the desired outcomes and the specific requirements to help clients achieve them. They also allow to identify new opportunities that may help clients to sustainably expand their business and improve their competitive advantage.

By adhering to the IFC Performance Standards, BIO's clients are guided in responsibly managing their environmental and social risks, addressing crucial topics such as:

BIO classifies its investments based on their associated environmental and social risks. Categories A, B+, B, and C respectively represent projects with high, medium-high, medium-low, and low potential impact. For projects carrying higher risks, BIO collaborates closely with its clients to define appropriate environmental and social actions, subsequently monitoring the outcomes of these efforts.

BIO actively engages with (prospective) clients to enhance their E&S performance, with its dedicated E&S team offering valuable advice, appropriate tools, and assistance in developing tailored E&S action plans to drive improvements.

In line with its commitment to robust E&S management, BIO requires an E&S action plan (ESAP) to be part of the investment contracts for all signed projects. Almost all of them incorporate measures related to E&S risk management (IFC - PS 1), with 60% of them encompassing actions addressing labour conditions (IFC - PS 2). For high-risk projects (A and B+), on-site visits are conducted by BIO and/or external experts to verify reporting and conduct independent assessments. Annual progress reports on the ESAP's various measures and actions are submitted by clients, reflecting the extent to which they remain on track.

ESAP implementation progress

Out of the 81 projects actively monitored by BIO’s E&S team (signed after 2018), 74 had an E&S action plan. The majority has already been implemented and completed or is on the right track to do so, whereas for 30% of the action plans implementation has been delayed.

When challenges arise and insufficient progress is noted, BIO talks to its clients to identify why, and to see how they can catch up on the ESAP's execution. Common causes of delays include unexpected business issues for entrepreneurs, capacity constraints, and human resource limitations.

BIO is committed to supporting its clients in bolstering their E&S capacity and competences, providing assistance through the BDSF or by offering guidance and training sessions led by BIO staff. Companies posing a higher reputational risk or companies in non-compliance with essential actions outlined in their ESAP are placed on an E&S watchlist, prompting intensified monitoring by BIO's E&S team. As of the end of 2022, four projects were on this list, out of a total of 146.

We provide grant resources to incentivize our clients to work on improving their sustainable practices and support them becoming examples in their sector.

International certifications such as ISO, Fairtrade, Organic or FSC can be instrumental in reaching a company’s objectives. Grants from BDSF can help clients to obtain these. Alternatively, technical assistance and feasibility studies may be used to finance gender equality programmes, to create green financial products, to implement best lending practices, and develop client protection measures for the final beneficiaries of microfinance institutions. To ensure an alignment of interests and maximise a project’s chances of success, BIO always requires clients to bear part of the costs of the subsidised activities.

The BDSF has an annual budget of EUR 2 M. Since it established TA funds in 2005, it has supported 199 projects. Over the past five years alone, it has approved co-financing for 68 projects, amounting to EUR 5 M. Notably, 2022 was the year with the highest number of projects approved (20), for a total amount of EUR 1.7 M.

TA, FS and TAF

Technical assistance improves a company’s economic, social, and environmental impact by co-financing pivotal initiatives, such as the development of an environmental and social action plan, the digital product innovations for microfinance institutions, or the establishment of a business training centre for a bank’s SME clients.

Feasibility studies play an indispensable role in analysing the technical viability and profitability of an investment project. These studies may range from an environmental and social impact assessment for a new solar project to a comprehensive market and technical analysis for an agribusiness venture.

Technical assistance facilities are created by funds to pool the contributions of their investors and make them available for their clients. They are the indirect equivalent of direct technical assistance and feasibility studies.