Industry, innovation and infrastructure

Industry, innovation, and infrastructure are fundamental for developing countries, they generate employment and income for a dynamic economy.

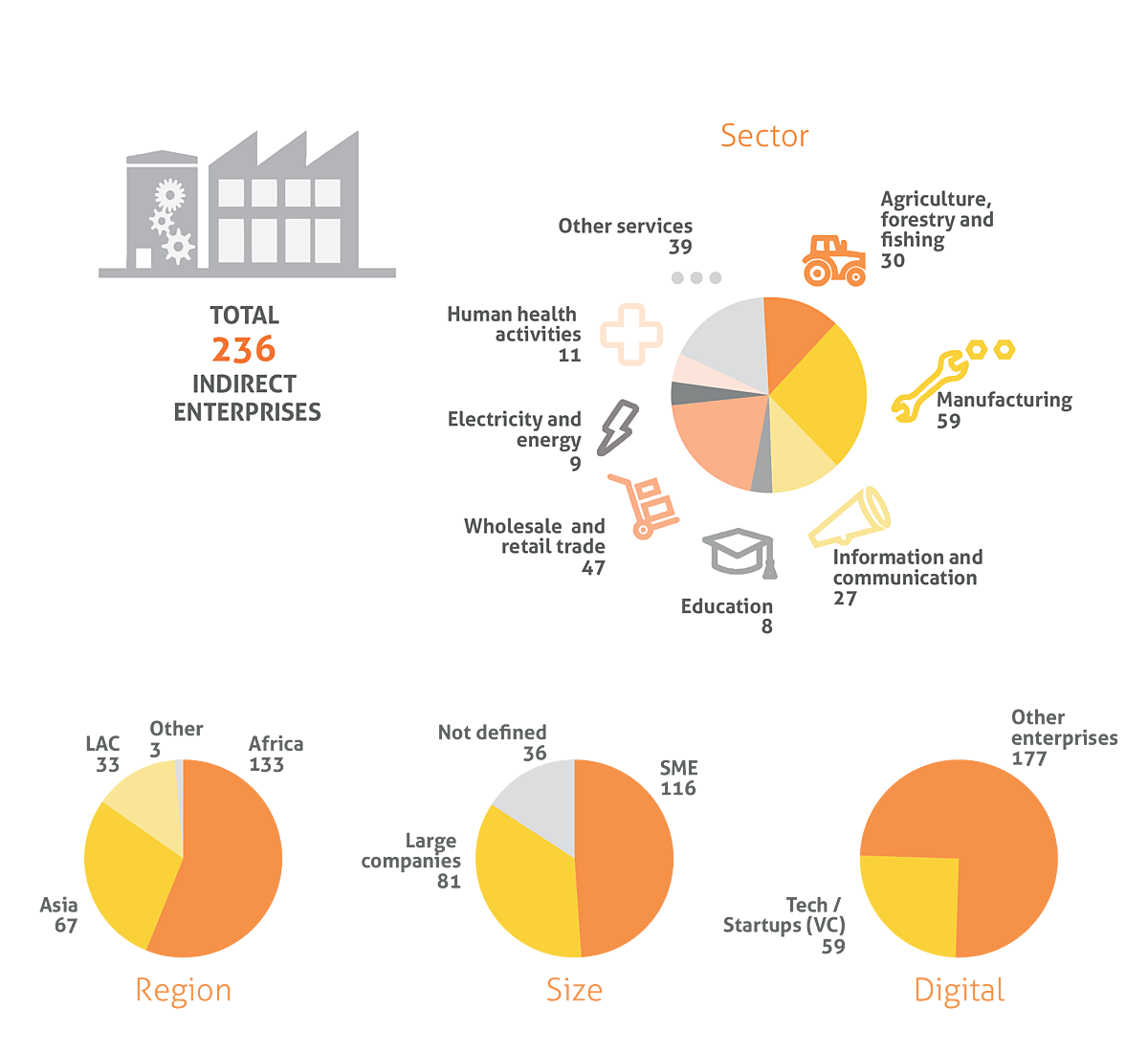

Manufacturing, technology, agriculture and digital innovation are key sectors for BIO, since they represent the backbone of a dynamic and resilient private sector. BIO indirectly invests in 236 enterprises, among which 59 manufacturing companies and 36 ICT or energy projects. A fourth of its investees are tech-related or digital startups, financed through venture capital funds.

Twelve of the 23 new investments that were approved in 2022 have private sector innovation and SDG9 as a primary goal.

SMEs have trouble finding financing, especially long-term capital, in emerging markets. For smaller and more informal businesses, this is even more difficult.

BIO’s financing contributes directly and indirectly to the growth potential of these companies. It is currently directly invested in 18 SMEs that are active in the manufacturing sector or the agricultural value chain.

Victoria Commercial Bank

In 2021, BIO committed to invest USD 10 M in Victoria Commercial Bank, to support the growth of the SME loan portfolio.

VCB is a Tier III bank in Kenya, active in the country since 1987, that serves mostly SMEs (92% of the loan book), with lending and deposit products along with a high-quality service.

While the bank used to be more focused on the manufacturing sector, it’s increasingly active in other markets, especially the agriculture value chain. With its investments in the agriculture sector and partnerships with other actors strategically located in non-urban areas, the bank positively impacts rural development and contributes to increase the lending offer for smallholder farmers.

Moreover, VCB is very advanced when it comes to digital services and its ability to reach its clients. Victoria Commercial Bank has put in place very strong E&S practices with a very exhaustive E&S policy and manual, implemented by a knowledgeable ESG officer, and demonstrates good practices to its peers.

BIO's indirect investments through financial institutions and private equity funds support a much larger number of SMEs in these sectors and others. BIO’s key objective when investing in financial institutions is to increase their loans and services to SMEs, and for them to provide the necessary market knowledge, product distribution channels, and support to these clients.

In 2021, the 44 financial institutions in BIO's direct portfolio granted at least 148,000 loans to SMEs, of which 72,000 to small companies and 76,000 to medium-sized companies. Private equity funds also provide long-term capital to enterprises. Moreover, these funds’ teams actively participate in the governance and strategic management of their investees, adding value, especially to relatively young companies and start-ups.

In 2021, BIO had a total outstanding amount of EUR 144.1 million in 47 investment funds. These are mostly SME-focused private equity funds that are active in Africa. Together they are currently invested in 236 companies, 131 (micro-)finance institutions and 59 (small-scale) energy infrastructure projects.

Financing SMEs has great potential for environmental and social improvements, but also poses risks. SMEs face challenges with respect to pollution, lack of permits, threats to biodiversity, labour issues, dangers to human health, and impacts on communities. It is therefore crucial to address these risks, to mitigate them, and to strengthen the sustainability of doing business.

Therefore, BIO works with its (prospective) clients to actively identify opportunities for improvements in the E&S performance throughout BIO’s investment period. The beneficiaries can call on BIO’s Business Development Support Fund to co-finance E&S related studies, evaluations, trainings, and third-party expertise.

Because of their nature, financial institutions and funds themselves usually don’t have a large direct E&S footprint. However, their clients and investees often do. That is why financial institutions and funds must insist that these develop and implement an environmental and social management system. BIO can provide them with technical assistance to support this effort.

Digital for Development

Digitalisation plays an important role in reaching the SDGs, and can catalyse companies’ efficiency and effectiveness, in particular in developing products and services for more vulnerable groups. That is why digitalisation for development is a key BIO investment objective.

As they are generally still in the start-up or early development stage, highly technological companies in developing countries with a strong digital component are often financed by specialised private equity funds. These funds usually focus on agritech, fintech or healthtech. They have environmental and social policies and management systems (ESMS) in place that ensure that E&S risks are assessed and mitigated at all stages of the investment process.

In 2022, BIO invested USD 4 million in equity in the Lendable MSME FinTech Credit Fund, following a loan in 2020. The fund aims to address the financial and technical needs of early to mid-stage digital companies in Africa and Asia. At BIO’s request, it added digital-specific E&S topics including data privacy and ethical use, and data security into its ESMS.

Finally, the Business Development Support Fund has grants available to strengthen the digitalisation of products, services, internal processes, staff capacity, and the protection of clients’ personal data.

Convergence Partners Digital Infrastructure Fund

CPDIF is another good illustration of how BIO supports funds to enable infrastructure for the digital economy across sub-Saharan Africa.

In 2022, BIO committed to invest USD 10 M in Convergence Partners Digital Infrastructure Fund LP, a private equity fund that invests in digital infrastructure and the ICT sector, with a focus on fibre, wireless, data centres, 5G and digital service provider platforms.

The fund’s investments help to provide a more reliable, affordable and accessible internet connection for businesses and the population, in South Africa, Nigeria, Ghana, and Kenya mainly, where such infrastructure is currently scarce.

The digital sector is highly impactful and crucial for private sector consolidation and innovation: telecom infrastructure represents the backbone and key enabler of the digital economy, thus being critical to the creation of many digital markets and to the improvement of many real markets. CPDIF has a strong focus on closing the digital inclusion gap and measures its objectives quantitatively: its investees report on several aspects, like broadband access, employment creation, taxes paid, kilometres of fibre laid, homes and schools passed, and number of towers.

One of the first investments of the fund was Ctrack, a leading telematics Software-as-a-Service vendor providing fleet management analytics, insurance risk solutions and asset tracking solutions in South Africa.

TIDE Africa

BIO invested in TIDE Africa I (Technology and Innovation for Developing Economies Africa I Fund) and in TIDE Africa II. They invest in venture capital (VC) associated with technology, innovation, and value generation in sub-Saharan Africa (emphasis on Nigeria, Kenya and South Africa) and in Egypt.

The fund manager is committed to promote ESG best practices: they have already adopted an environmental and social management system covering all steps of the investment cycle and are willing to further institutionalise their E&S practices with the support of the DFIs.

Through this investment, BIO supports the sustainable growth of the African VC ecosystem, enhances the innovation and development of the digital-based economy to provide innovative solutions to local problems, and supports the next generation of African entrepreneurs.

"The fact that there is much less capital (in absolute and relative terms) for tech in Africa, makes the entrepreneurs laser focused and extremely resourceful, efficient and agile when it comes to growing their startups.

The lack of infrastructure creates some challenges, such as the need to get involved in many parts of the value chain of each sector as the existing industries are less mature. On the other hand, it creates a fantastic environment for tech driven innovation."

Ido Sum, partner at TLCom Capital