Gender equality

Gender equality is a fundamental human right and is integrated in all BIO's projects, strategies, policies, and actions.

Despite some progress in recent years, according to the UN gender inequality index, no country in the world has achieved full gender equality, nor are they expected to achieve it before 2030. Despite being the numerical majority, women are a minority in leadership positions and politics all around the globe. Because of increased household burdens and heightened risk of violence, they are also usually affected the worst by crises, such as the pandemic or climate change.

Since such gender inequalities pose a real barrier to sustainable and inclusive development, and could seriously harm the businesses themselves, Development Finance Institutions like BIO have intensified their efforts to reduce them.

For BIO, gender equality is a fundamental human right. Since 2018, the topic of gender justice has been increasingly integrated in its strategic thinking and in all of its operations. Beyond merely increasing the number of female employees or clients of a company, BIO’s gender strategy focuses on empowering women by enhancing their economic opportunities. To create these opportunities, BIO has adopted a 360° gender lens, to look at gender from all angles, considering all the roles women can have in a company: entrepreneurs, leaders, workers, consumers, and community members. This lens provides a framework to collect gender-related information, evaluate key dimensions of gender equality, and engage with clients on gender-related issues.

By supporting its partners empower women in their workplace, value chains and stakeholder network, BIO contributes to tackling gender inequality, one of the major barriers to sustainable development.

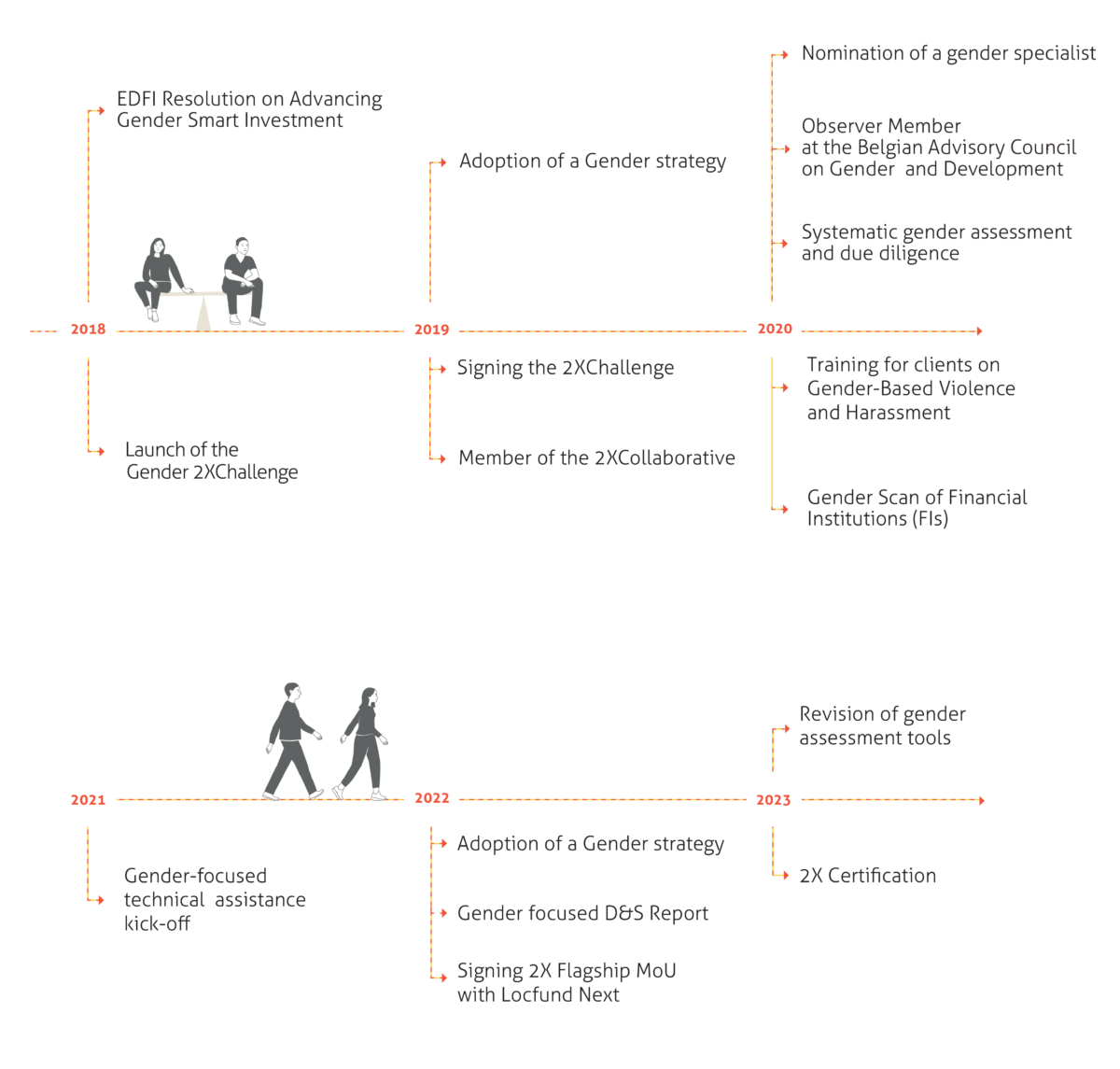

Timeline of major gender equality steps at BIO

Partnership for the goals

BIO is a member of 2X Global, a global organisation dedicated to unlocking gender-smart capital on a significant scale. It brings together gender experts from development finance institutions and other leading investors to support the development of shared financing principles, definitions and methodologies that promote the integration of gender-smart decision-making into investment processes and operations.

An essential part of this agenda is the 2X Challenge, an initiative launched at the G7 Summit in 2018 which seeks to inspire DFIs to concentrate their financing efforts on advancing women's economic empowerment and fostering gender equality. This challenge calls for directing resources towards initiatives that enable women in developing nations to access leadership opportunities, quality employment, financial support, enterprise resources, and products and services that promote the inclusion of women and girls.

Flagship Funds

In partnership with 2X Challenge participants, we created and maintain a now-widely-recognised label for gender-smart funds whose fund managers make ambitious commitments to gender targets at both the fund manager and the portfolio level. Flagship Funds are nominated and then awarded special recognition by an independent 2X committee of industry leaders.

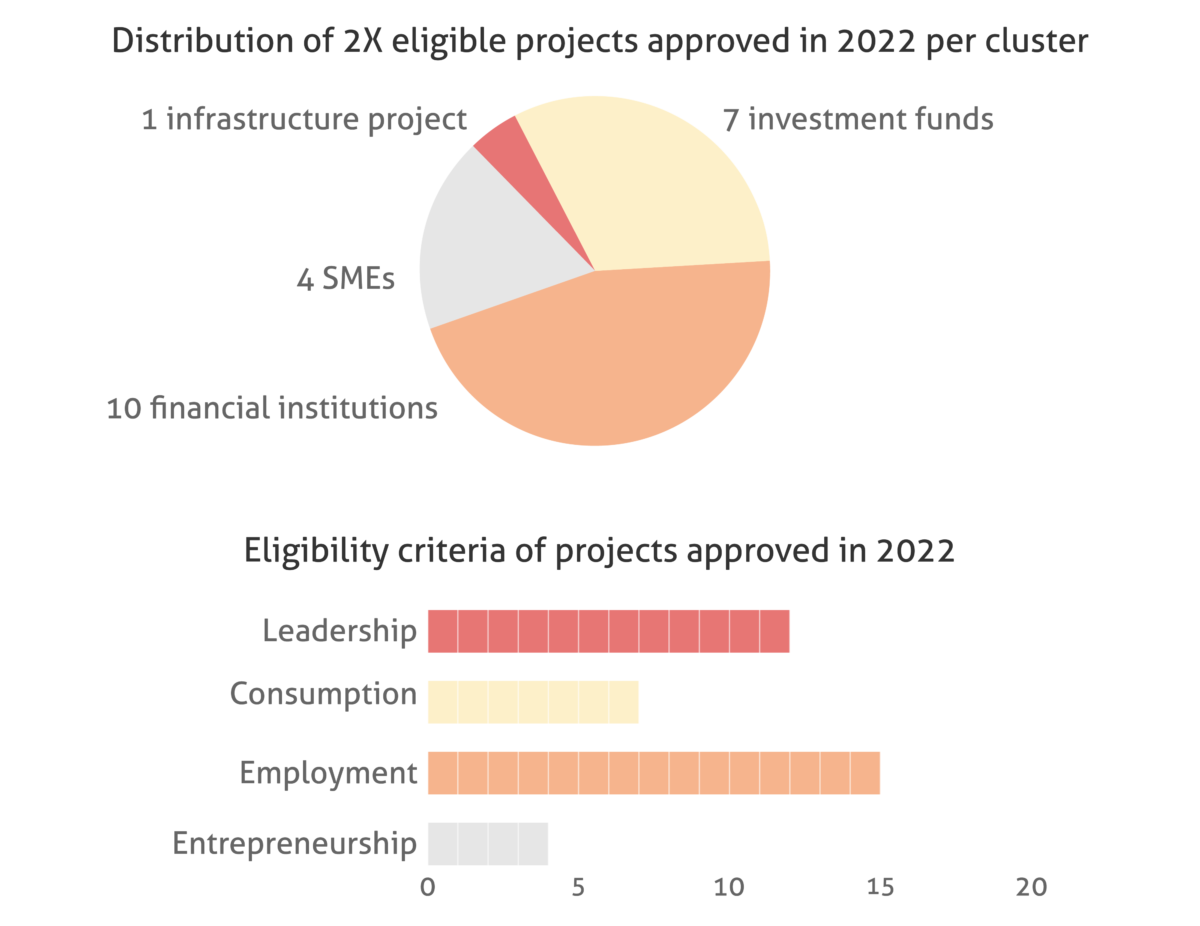

2X eligibility

To qualify for the 2X Challenge, a client must formally (commit to) achieve at least one of the following criteria:

- Entrepreneurship – The business is founded by a woman who still maintains an active role OR holds more than 51% in shares.

- Leadership – 30% of women are in senior management OR 30% sit on the board or the investment committee.

- Employment – At least 40% of employees are female AND a policy or programme is in place to address barriers to women’s quality employment (beyond those required by local law or compliance).

- Consumption – The company provides products that address women’s unique needs, address a problem disproportionally impacting women, or that have a majority of female customers or beneficiaries.

For each new potential project, BIO assesses its potential impact on gender equality by examining existing policies and strategies, and by determining its eligibility for the 2X Challenge. This evaluation helps gauge the investment's expected contribution to promote gender equality. The 2X criteria have been updated by 2X Global and today (2023) are being integrated in BIO's procedures.

Out of the 22 2X eligible projects (for a total amount of EUR 180 M) approved last year, most projects scored well on the leadership and employment criteria, while half of the projects approved in 2022 qualify on at least two 2X criteria.

Northern Arc India Impact Fund

In November 2022, BIO invested INR 650 M in the Northern Arc India Impact Fund (NAIFF), a private debt fund focused on India. BIO is the first DFI to invest.

NAIIF has adopted a Gender Lens Investing Framework, integrating gender considerations in its credit and underwriting process. The framework includes a gender equality policy, procedural guidance on how to apply it, and the instruments and tools to do so.

NAIIF meets all 2X criteria, confirming its dedication to advancing women's economic empowerment and fostering gender equality.

- Entrepreneurship: One of the founding members of NAIIF is Ms Fernandes, who retains an active role in the company.

- Leadership: Two out of five members of the investment committee and 45% of the senior management are women.

- Employment: Six out of the 14 employees of the fund are women, and there are many policies and initiatives in place supporting gender equality at work.

- Investment through financial intermediaries: 35% of the fund’s portfolio is invested in companies that have a focus on gender and/or are led by women, and all MFIs targeted by the fund have 100% female clientele.

Ms Rajani Srichandana, a farmer's wife from a rural family of ten, experienced a remarkable transformation with the support of Annapurna Finance, an investee of the Northern Arc India Impact Fund. Previously relying solely on farming income, Rajani's life changed when she received financial literacy trainings from Annapurna. Empowered by this knowledge, she secured loans to start a grocery shop and invest in a dairy business. Now, she owns fourteen cows that produce 100 litres of milk daily, and Rajani's family thrives since they no longer have to depend on local moneylenders thanks to the collaborative efforts of Annapurna Finance and the Northern Arc India Impact Fund.

Kashf Foundation

Kashf Foundation is a microfinance institution in Pakistan dedicated to fostering women's empowerment amidst the unique challenges of the Pakistani context. Kashf stands out among its competitors, it’s recognised for its exceptional gender-focused strategy and provision of non-financial services. To further support its mission, BIO has granted a USD 10 million loan to this transformative MFI.

Kashf Foundation serves an active client base of approximately 500,000 low-income microentrepreneurs. The institution primarily offers individual loans with an average ticket size of USD 330, repayable over a twelve-month period. Almost all of Kashf's clients (99.8%) are women, with 60% of them first-time borrowers.

Kashf provides community developing training to raise awareness, break cultural barriers, and build capacity to effectively address gender-related challenges. In 2020, more than 12,500 individuals took part. In total, nearly 36,000 women have benefited from empowering training sessions on leadership, counselling for victims of violence, and women's rights education.

As a teacher, Deena adorned her home with handmade treasures from her hometown, Sindh. Encouraged by the people who saw them, she started a business to bring these unique pieces to everyone’s home.

Today, she proudly runs an online business, sourcing unique creations from talented artisans in Sindh. Each piece carries the essence of her culture and heritage, connecting hearts worldwide. Her children witnessed her struggles, but they also saw something greater: a role model who never gave up.

Kenya Commercial Bank

In 2022, a BDSF subsidy enabled the Kenya Commercial Bank (KCB) to develop a digital platform that offers business tools, virtual trainings, and a space for knowledge sharing between female business owners. Through this platform, KCB aspires to foster a vibrant ecosystem of networking opportunities and to facilitate positive spill-overs for its female clientele.