BIO Development & Sustainability Report 2023

Print the report

Click on the button to print the report. If you want to save as PDF, select this option in the Print dialog box.

BIO Development & Sustainability Report 2023

Promoting the Sustainable Development Goals by financing the private sector

Preface

BIO’s Development & Sustainability Report illustrates how BIO is translating its main mission and principal mandate into investments and business development support that contribute to the global community’s development aspirations.

Entrepreneurship is by far the largest source of employment in developing countries. Strengthening the private sector gives BIO an important lever to promote decent work and gender equality, and to fight poverty and climate change – the main barriers to human development.

The UN Sustainable Development Goals (SDGs) are our guide in our quest for impact. While we seek to contribute to achieving all 17 SDGs, this third edition of BIO’s Development and Sustainability Report has a special focus on SDG10: “Reduce inequality within and among countries.” BIO supports clients such as Banco Solidario, Ilara Health, and Barnana in Ecuador and Kenya in promoting inclusive businesses to reduce inequalities within countries in the short term, and in stimulating employment, private sector growth and productivity to reduce inequalities among countries in the long term. Many of our clients target un(der)served communities by being active in the agricultural value chain, in the health sector, and by providing them with microloans and/or micro-insurance products. Acting towards reducing inequalities is an essential objective in most of BIO’s investments.

By showing the impact they have had on reducing inequalities, Development Finance Institutions (DFIs) like BIO illustrate that they have become a key part of the development finance architecture, and are crucial in achieving the 2030 Sustainable Development Goals - and its central promise to leave no one behind.

Everybody concerned with international solidarity – not in the least BIO’s stakeholders: whether they be government, parliament, civil society or the Belgian taxpayer – can read here how BIO invests its money and seeks to improve people’s lives. This D&S Report provides an opportunity to look more closely at the issue of sustainable development and shows BIO’s commitment to promoting best practices to achieve a better world for all.

Géraldine Georges

Chair of BIO's board of directors

About this report

The goal of this online publication is to provide a comprehensive understanding of how investing in the private sector, with a clear focus on development effects and sustainability, can address some of the world’s major challenges. This report covers the financial year of 2021 and also includes examples of investments signed in 2022.

The section “Development and Sustainability at BIO” provides an overview of BIO’s role as a DFI and digs into its strategic approach and Theory of Change (ToC). It describes in detail the operational phases of assessment, monitoring, and evaluation (AME framework), illustrating the processes and methodologies employed. Following this, the section looks at BIO’s Environmental and Social (E&S) framework, which ensures the implementation of standards for decent and safe working conditions, the respect of human rights, and environmental sustainability. Lastly, it explains the role of the Business Development Support Fund (BDSF) in helping to improve sustainability, and it provides an overview of its main tools for technical assistance.

As described in the section “Sustainable Development Goals Highlights” and its subchapters, this publication aims to illustrate how BIO contributes to the six directly targeted SDGs. In particular, this year’s report has a focus on SDG10 (Reduced inequalities), an essential subject to BIO and object of the latest external case study evaluation (ECSE). The section calls attention to how BIO addresses income inequalities between and among countries, how it protects vulnerable clients in microfinance, and it illustrates some of the facts and figures relative to investments in Least Developed Countries (LDCs) and to investments targeting un(der)served groups.

Finally, the “Challenges and work in progress” section summarises the lessons learnt and the improving perspectives for the upcoming future.

Development and Sustainability at BIO

The private sector is crucial to achieving long-term, inclusive, and sustainable economic growth. It is responsible for over 90% of jobs in developing countries as well as for local value added, innovation, the provision of valuable goods and services, and tax revenue.

When looking at creating positive impact, the private sector is key in realising the Sustainable Development Goals by 2030 and actively contributes to mitigating poverty and reducing inequalities.

DFIs aim to create a strong, transformative, and responsible economy, mostly by working with investment capital.

DFIs play a significant role in supporting the private sector in developing countries. They aim to create a strong, transformative, and responsible economy, mostly by working with investment capital.

DFIs support the creation of profitable and sustainable businesses that also have a positive impact on society. While DFIs vary in governance, and in their sectoral and regional focus, they are all government-backed and, as such, they can take more risks and adopt a longer-term perspective.

DFIs strategically invest in locations and sectors that are considered risky and where conventional investors hesitate to tread. Leading by example, DFIs possess a catalytic effect, mobilising capital from more traditional private investors.

In summary, DFIs are investors who prioritise development impact over financial returns.

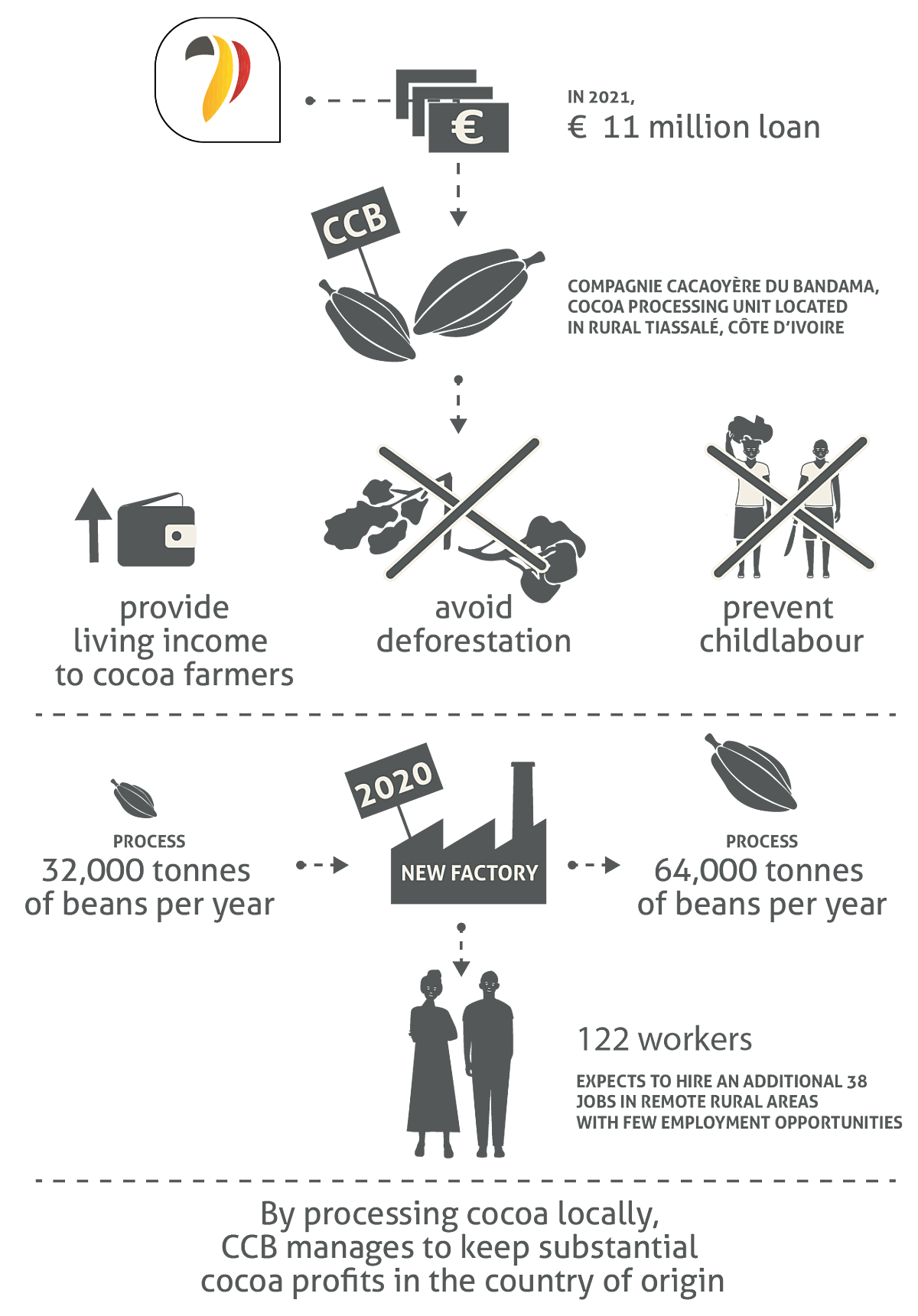

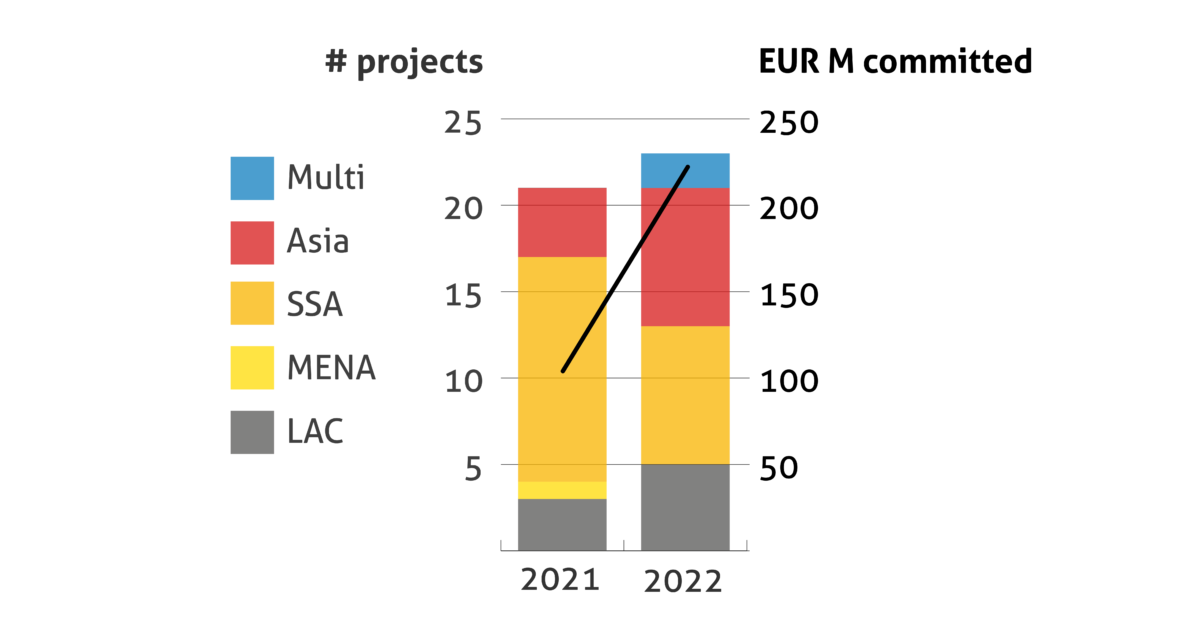

Evolution of new commitments

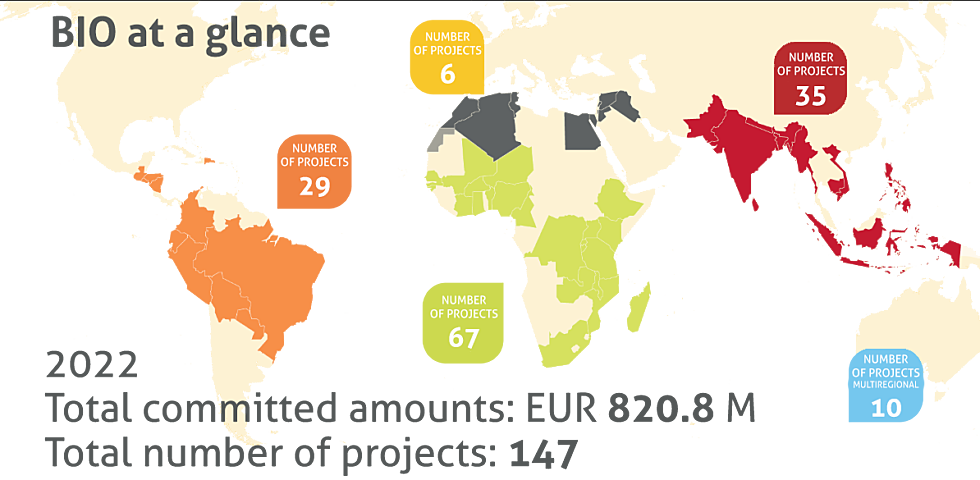

In 2022, BIO committed to provide funding for EUR 225 M in funding for 23 projects, most of which in sub-Saharan Africa and Asia. This represents an increase of about 10% in the number of projects but a more than doubled committed amount with respect to 2021. The geographic distribution of new projects focuses on sub-Saharan Africa and Asia, followed by Latin America and the Caribbean, and multi-regional projects.

The Belgian Investment Company for Developing Countries is Belgium’s DFI. It is fully owned by the Belgian State as a central instrument to advance its development cooperation objectives and principles. By investing in private enterprises that are (likely) to be(come) vulnerable to sustainable development issues, and by primarily focusing on micro, small, and medium-sized enterprises (MSMEs), BIO actively contributes to promoting sustainable human development in low- and middle-income countries.

Working hard to achieve maximum development impact, BIO assesses in which domains – gender, decent work, the fight against climate change, the promotion of basic services to the population, etc. – an investment project has high development potential. BIO then collaborates closely with sponsors to prioritise these aspects during project implementation.

It carefully assesses a client’s potential economic, social, and environmental challenges and proposes measures to mitigate these risks, with clear milestones for improvements over time. Additionally, BIO offers expert advice and technical assistance to enhance business management, performance, sustainability, and overall development effectiveness of its projects.

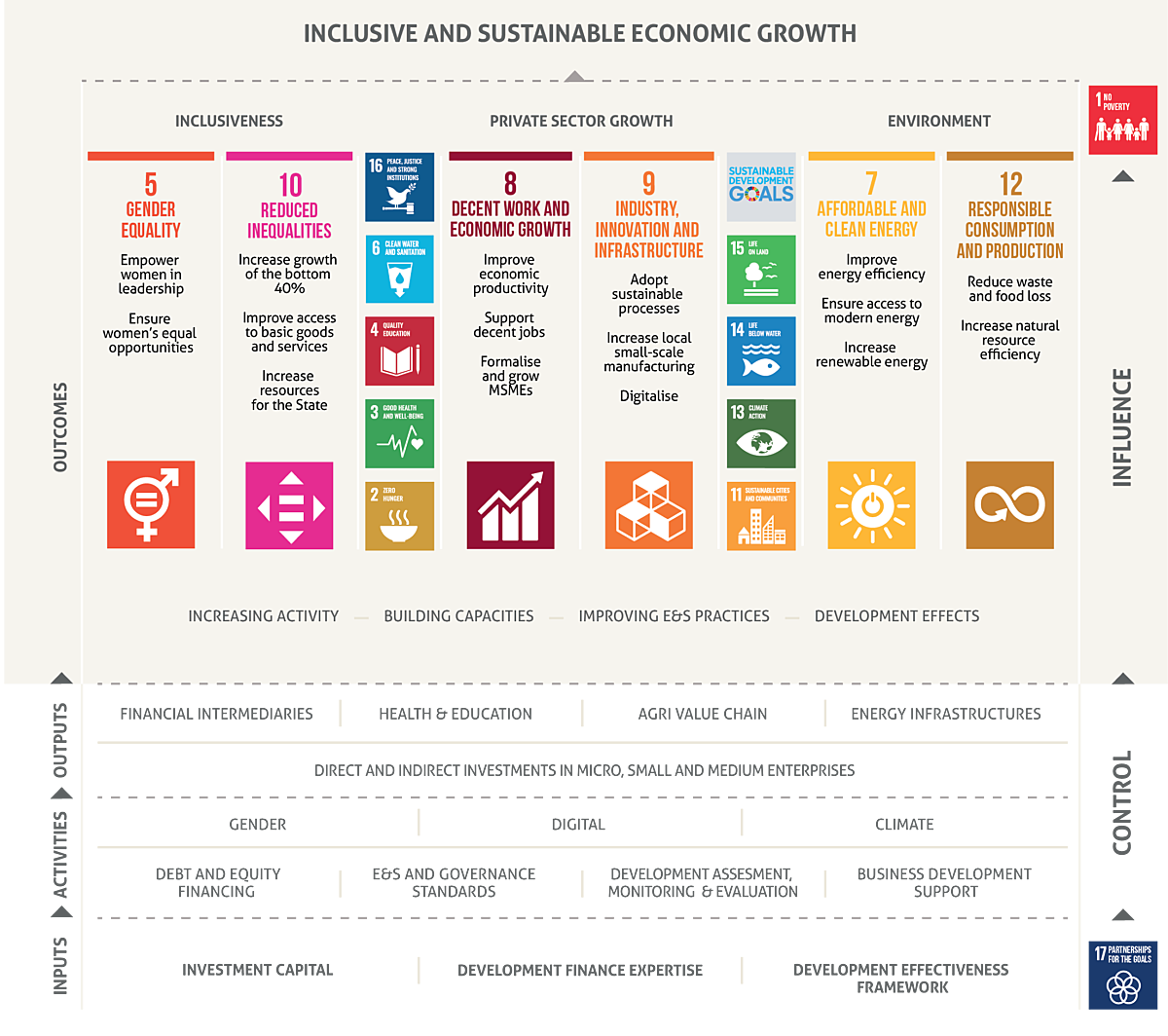

Since its establishment in 2001, BIO has diligently undertaken the task of assessing, monitoring, and evaluating the developmental outcomes of its portfolio companies. At the heart of this endeavour lies BIO's Theory of Change (ToC), a framework that aids in comprehending the true impact of its investments. This ToC offers an integrated approach, encompassing economic, social, and environmental development facets, while aligning strategically with six SDGs where BIO can wield its greatest influence.

The ToC also includes a set of key performance metrics that aim to capture BIO's significant contributions to each of the identified SDGs. In turn, BIO's Development Assessment, Monitoring, and Evaluation framework employs this ToC as a guide to measure its development impact.

This process of impact measurement and sustainability practices undergoes continual harmonisation with other European DFIs and impact investors. Through a structured, tangible, and transparent approach, this report illustrates BIO's contribution to the 2030 agenda, serving as a testament to BIO's commitment, not only to its investee companies but also to the Belgian State, the development community, civil society, and the wider public, all of whom are stakeholders in this pursuit.

Theory of Change and the SDGs

BIO’s Theory of Change provides a comprehensive description of its contribution to the 2030 agenda. Although the SDGs are not perfect and are sometimes difficult to quantify, they are the reference and guidance for BIO’s development mission because they represent the global agreement on what we all strive for in terms of a better world for all.

BIO’s ToC outlines the links between inputs, outputs, outcomes, and (expected) development impacts. It uses this framework to develop sustainable entrepreneurship in developing countries and to contribute to a world without poverty, where economic growth is inclusive and jobs are sustainable, in line with SDG1. BIO’s clients are expected to contribute to a number of SDGs. They can reduce gender inequalities (SDG5), provide affordable and clean energy (SDG7), create decent work and economic growth (SDG8), build innovative industries and infrastructure (SDG9), work on social inclusion (SDG10), or practise good environmental standards for responsible production and consumption (SDG12). These are priority goals for BIO and sustain most of BIO’s activities and departments. Other SDGs may also be relevant to BIO and its clients, but are dealt with more indirectly. For instance, the various projects in the agricultural sector contribute to SDG2. More transversally, by supporting climate change mitigation and adaptation, BIO contributes to SDG13. In addition, by ensuring that clients comply with BIO’s E&S policy, it also contributes to good health and wellbeing (SDG3), to the protection of the oceans and marine resources (SDG14), and to the conservation and sustainable use of terrestrial and other ecosystems (SDG15).

About OPIM

BIO is a signatory to the Operating Principles for Impact Management (OPIM). This is a framework to ensure that impact considerations are integrated throughout the investment lifecycle. The principles draw on emerging best practices from a range of asset managers, asset owners, asset allocators, and development finance institutions. Mid-2023 OPIM had 176 signatories from 39 countries and covered total assets of USD 516,400 M.

BIO forges valuable partnerships with its fellow European Development Finance Institutions through EDFI. It actively collaborates with other influential development actors, such as the Belgian development agency, Enabel, and mobilises funds from the private sector (SDG17), amongst others through the SDG Frontier Fund.

The SDG Frontier Fund is a closed-end, self-managed private equity fund of funds, focusing on SMEs across sectors in frontier markets of Africa and Asia in order to promote job creation and sustainable economic growth. In 2022, the fund reached its final closing for a total fund size of EUR 36 M, thanks to the participation of four additional Belgian private investors, including Ghent University and Ethias. The Fund aims to invest in 10 to 12 funds, which in turn will each invest in half a dozen to a dozen local small and medium-sized enterprises. In this way, more than a hundred SMEs will receive support. Three years after its creation, the SDG Frontier Fund already participates in ten funds active in Asia and Africa.

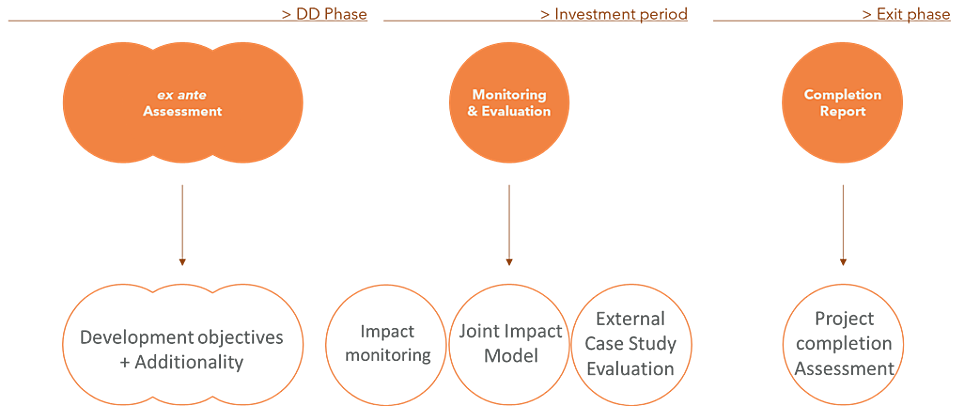

- Development ex ante Assessment Tool – As part of the due diligence, the tool allows to structure and document the development rationale of a given investment project, its contribution to the 8 BIO development goals (BDGs), and its financial and non-financial additionality. The potential on certain strategic, cross-cutting topics like gender or climate is also assessed.

- Monitoring Tool – Yearly monitoring of key development metrics (pre-defined set of indicators reflecting the envisaged development goals) for all portfolio projects – and Joint Impact Model (JIM) – Economic modelling to assess indirect effects.

- External Case Study Evaluation (ECSE) – Annual independent in-depth development effectiveness evaluation of a sample of ongoing or exited projects.

- Project Completion Tool – Ex post review and summary of a project’s main achievements (including business, finance, development, and E&S) and key lessons learnt that will be used to improve operational and strategic investment decisions, as well as operational processes.

While there is some interdependence between these, each tool follows its own procedure and addresses specific needs at different stages of the investment process.

The toolset is regularly updated to ensure continuous improvements in the fitness for purpose of the AME framework.

Due diligence

Ex ante assessment

Every new investment project must demonstrate a substantial primary or secondary contribution to at least one of BIO's development goals. The ex ante assessment also meticulously evaluates BIO's financial and non-financial additionality to the project, and assesses the potential on transversal topics (like gender or climate), which often results in concrete actions to be undertaken by the client and possibly supported by BIO as part of its non-financial additionality. The outcome of the ex-ante evaluation is presented in a simple scorecard with the project's anticipated developmental impacts.

Investment period

Results-based monitoring and external evaluation

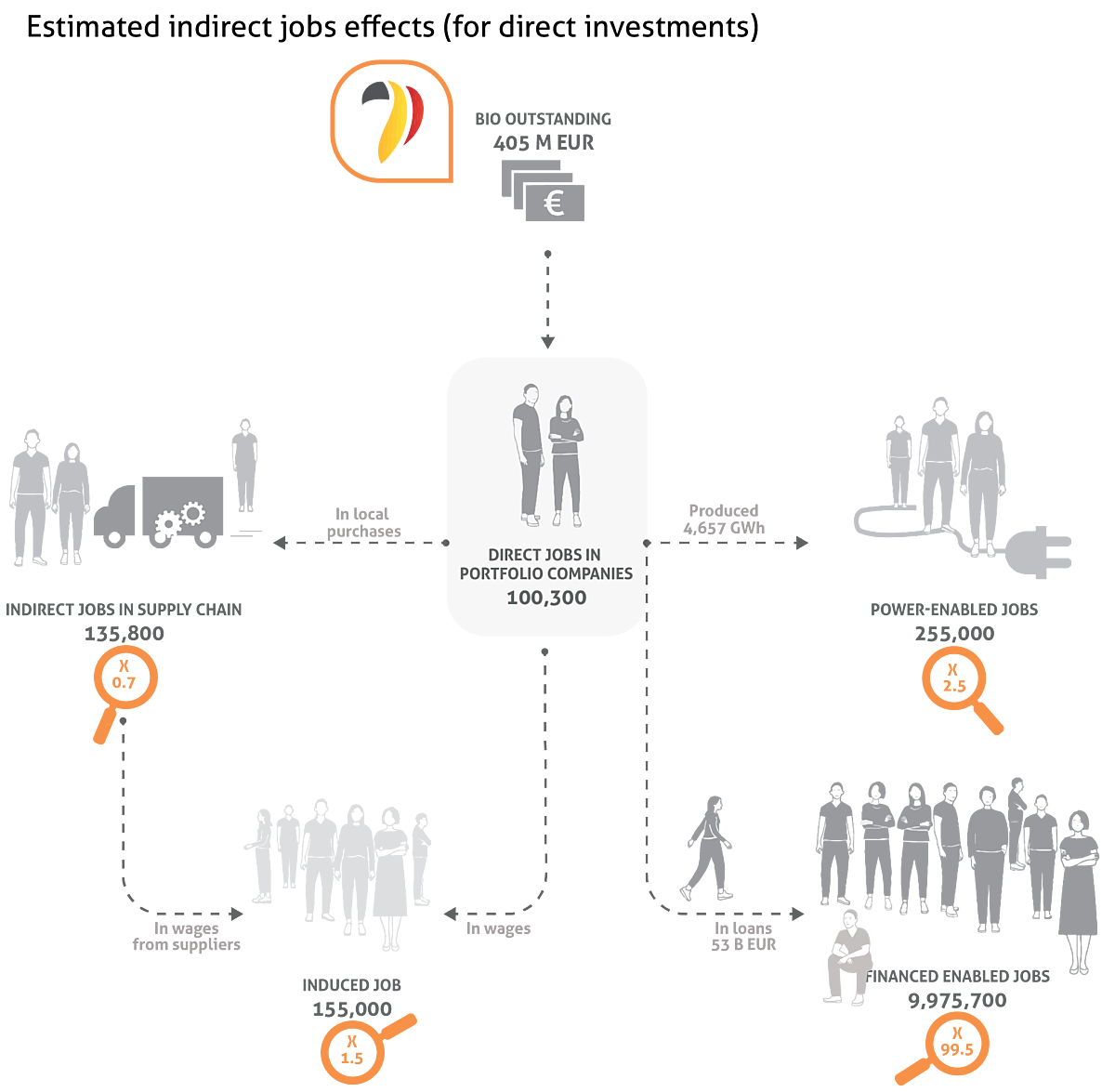

Following an investment, BIO monitors a project's developmental impact annually, using a range of standardised quantitative indicators and targets aligned with the SDGs. Since 2020, BIO has also been using the Joint Impact Model (JIM) to better take into account the indirect effects associated with portfolio projects.

Every year, BIO commissions an independent Case Study Evaluation to explore its impact from a specific thematic or sectoral perspective. This annual evaluation provides BIO with insights into the development effectiveness of its activities, through an analysis of its portfolio and an in-depth assessment of at least five ongoing or completed investment projects.

Exit phase

Project completion assessment.

Upon the completion of an investment project, BIO's team of development experts conducts an ex post analysis of its principal achievements and distils the lessons learnt. In addition to looking at the development effects, they also review the business, financial, environmental, and social outcomes, ensuring a comprehensive and well-rounded assessment of the project's overall impact.

All investments by BIO and the SDG Frontier Fund pass through a similar cycle. Upon identifying a potential investment opportunity, BIO thoroughly assesses its alignment with the overarching investment strategy and its adherence to the prescribed investment conditions. If the criteria are met, a comprehensive due diligence exercise ensues, scrutinizing the project's governance, commercial viability, and financial aspects.

BIO also identifies environmental and social risks and opportunities, working closely with its clients to unlock the full development potential of the project. This crucial development aspect is thoroughly discussed from the outset, ensuring a shared vision between BIO and its investees.

Together, BIO and its investees establish a clear understanding of the expected development impacts, identifying areas where technical assistance may be required to bolster the project's success. Moreover, a concerted effort is made to create value not only for the company itself but also for its workforce and stakeholders, fostering a holistic approach to sustainable and impactful investment.

About JIM

Using input data such as revenue and power production from portfolio investments, the Joint Impact Model enables to estimate financial flows through the economy and its resulting economic (value added), social (employment), and environmental (greenhouse gas emissions) impact. These estimates can be used to measure and report on the contribution of individual institutions to the UN Sustainable Development Goals and the Paris Agreement.

The JIM is characterised by its harmonised and transparent methodology and assumptions, public availability, collaborative nature, up-to-date macroeconomic statistics, security features and user operated style.

About ECSE

The External Case Study Evaluation is an annual independent, thorough assessment of a sample of ongoing or completed projects, carried out to explore the developmental effectiveness of BIO's interventions. This evaluation typically centres on a specific theme, sector, or region, and uses desk research, surveys, interviews, extensive field visits, and reality checks to ensure comprehensive and accurate assessments.

In 2022, the external evaluation focused on BIO’s contribution to reducing inequalities, while in 2023, it will assess how BIO promotes decent work for all.

The IFC Performance Standards are the key reference when assessing BIO’s clients’ E&S performance. They cover a comprehensive array of environmental, social, and human rights topics. Each standard describes the desired outcomes and the specific requirements to help clients achieve them. They also allow to identify new opportunities that may help clients to sustainably expand their business and improve their competitive advantage.

By adhering to the IFC Performance Standards, BIO's clients are guided in responsibly managing their environmental and social risks, addressing crucial topics such as:

BIO classifies its investments based on their associated environmental and social risks. Categories A, B+, B, and C respectively represent projects with high, medium-high, medium-low, and low potential impact. For projects carrying higher risks, BIO collaborates closely with its clients to define appropriate environmental and social actions, subsequently monitoring the outcomes of these efforts.

BIO actively engages with (prospective) clients to enhance their E&S performance, with its dedicated E&S team offering valuable advice, appropriate tools, and assistance in developing tailored E&S action plans to drive improvements.

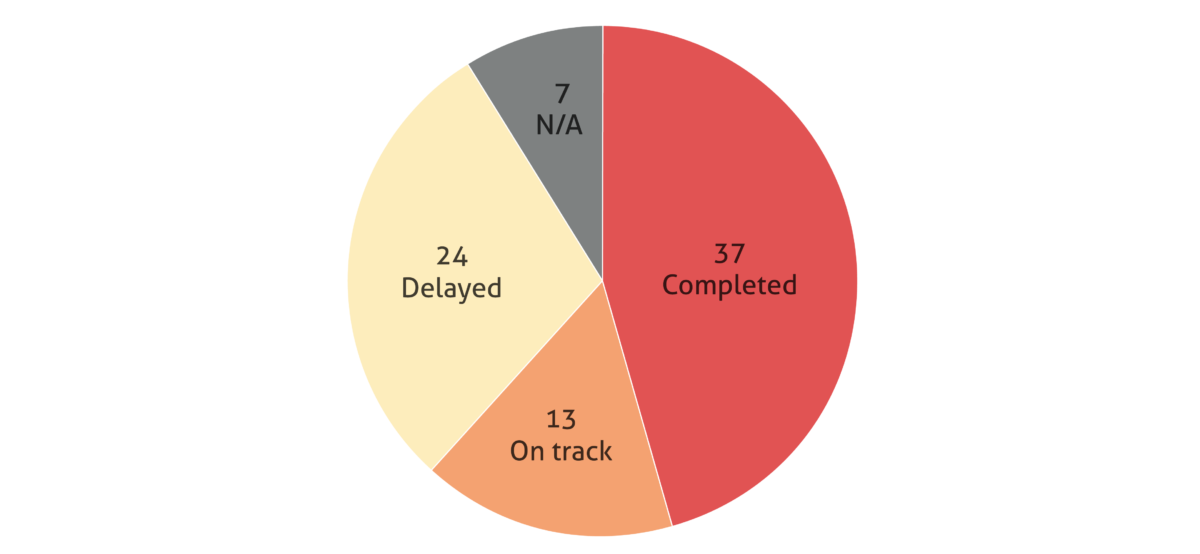

In line with its commitment to robust E&S management, BIO requires an E&S action plan (ESAP) to be part of the investment contracts for all signed projects. Almost all of them incorporate measures related to E&S risk management (IFC - PS 1), with 60% of them encompassing actions addressing labour conditions (IFC - PS 2). For high-risk projects (A and B+), on-site visits are conducted by BIO and/or external experts to verify reporting and conduct independent assessments. Annual progress reports on the ESAP's various measures and actions are submitted by clients, reflecting the extent to which they remain on track.

ESAP implementation progress

Out of the 81 projects actively monitored by BIO’s E&S team (signed after 2018), 74 had an E&S action plan. The majority has already been implemented and completed or is on the right track to do so, whereas for 30% of the action plans implementation has been delayed.

When challenges arise and insufficient progress is noted, BIO talks to its clients to identify why, and to see how they can catch up on the ESAP's execution. Common causes of delays include unexpected business issues for entrepreneurs, capacity constraints, and human resource limitations.

BIO is committed to supporting its clients in bolstering their E&S capacity and competences, providing assistance through the BDSF or by offering guidance and training sessions led by BIO staff. Companies posing a higher reputational risk or companies in non-compliance with essential actions outlined in their ESAP are placed on an E&S watchlist, prompting intensified monitoring by BIO's E&S team. As of the end of 2022, four projects were on this list, out of a total of 146.

We provide grant resources to incentivize our clients to work on improving their sustainable practices and support them becoming examples in their sector.

International certifications such as ISO, Fairtrade, Organic or FSC can be instrumental in reaching a company’s objectives. Grants from BDSF can help clients to obtain these. Alternatively, technical assistance and feasibility studies may be used to finance gender equality programmes, to create green financial products, to implement best lending practices, and develop client protection measures for the final beneficiaries of microfinance institutions. To ensure an alignment of interests and maximise a project’s chances of success, BIO always requires clients to bear part of the costs of the subsidised activities.

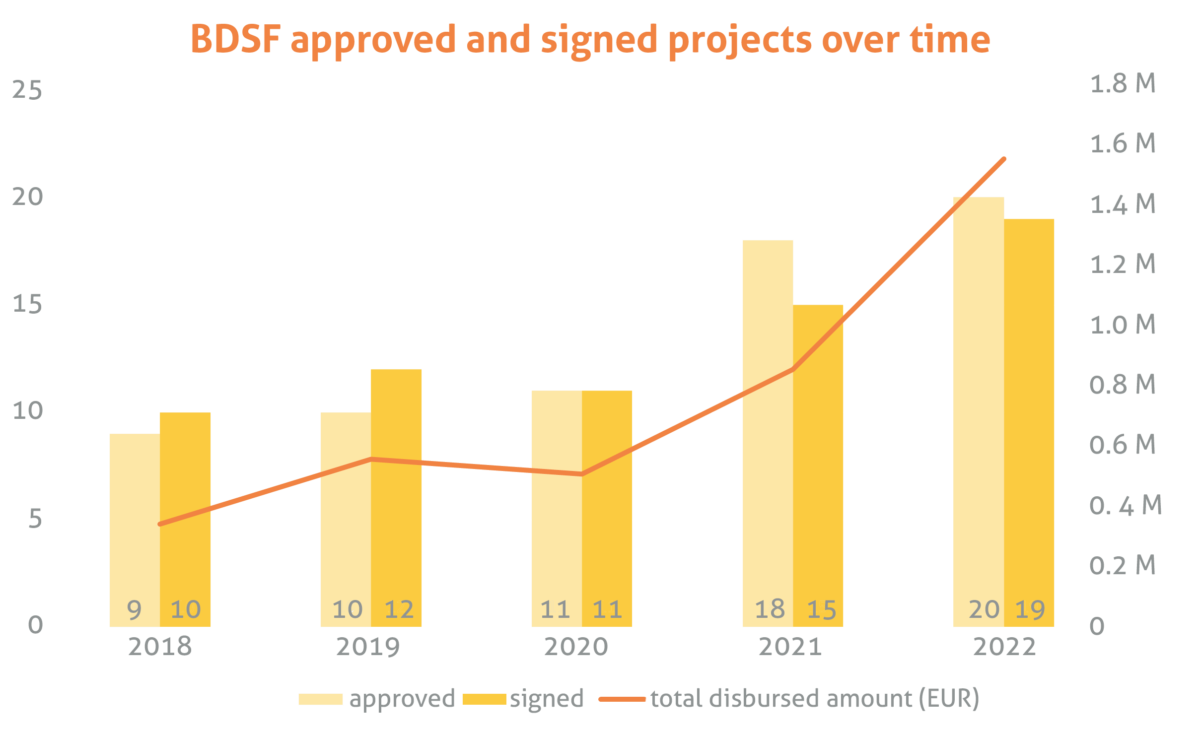

The BDSF has an annual budget of EUR 2 M. Since it established TA funds in 2005, it has supported 199 projects. Over the past five years alone, it has approved co-financing for 68 projects, amounting to EUR 5 M. Notably, 2022 was the year with the highest number of projects approved (20), for a total amount of EUR 1.7 M.

TA, FS and TAF

Technical assistance improves a company’s economic, social, and environmental impact by co-financing pivotal initiatives, such as the development of an environmental and social action plan, the digital product innovations for microfinance institutions, or the establishment of a business training centre for a bank’s SME clients.

Feasibility studies play an indispensable role in analysing the technical viability and profitability of an investment project. These studies may range from an environmental and social impact assessment for a new solar project to a comprehensive market and technical analysis for an agribusiness venture.

Technical assistance facilities are created by funds to pool the contributions of their investors and make them available for their clients. They are the indirect equivalent of direct technical assistance and feasibility studies.

Sustainable Development Goals

The Sustainable Development Goals (SDGs) are a universal call to action to end poverty, protect the planet, and ensure that all people enjoy peace and prosperity. BIO contributes to inclusive and sustainable economic growth by integrating the Goals in its decision-making processes and strategy.

Due to its specific mandate, BIO focuses on private sector growth, inclusiveness, and attention to the environment as core values and desired outcomes resulting from its interventions. This translates in a direct contribution to SDG5 and SDG10 (inclusiveness), SDG8 and SDG9 (private sector), and SDG7 and SDG12 (environment). These SDGs are linked to BIO’s Development Goals (BDGs) as explained in the Theory of Change and are thus integrated in the operations of assessment, monitoring, and evaluation of the investment projects.

More transversally, BIO contributes to the other SDGs, for example by investing in the agri-value chain (SDG2) or by steering its projects towards reducing GHG emissions (SDG13). Overall, BIO collaborates and cooperates with other institutions like Enabel or EDFI to strengthen the collective effort towards the achievement of the goals (SDG17). This report highlights the six SDGs to which BIO directly contributes.

SDG5

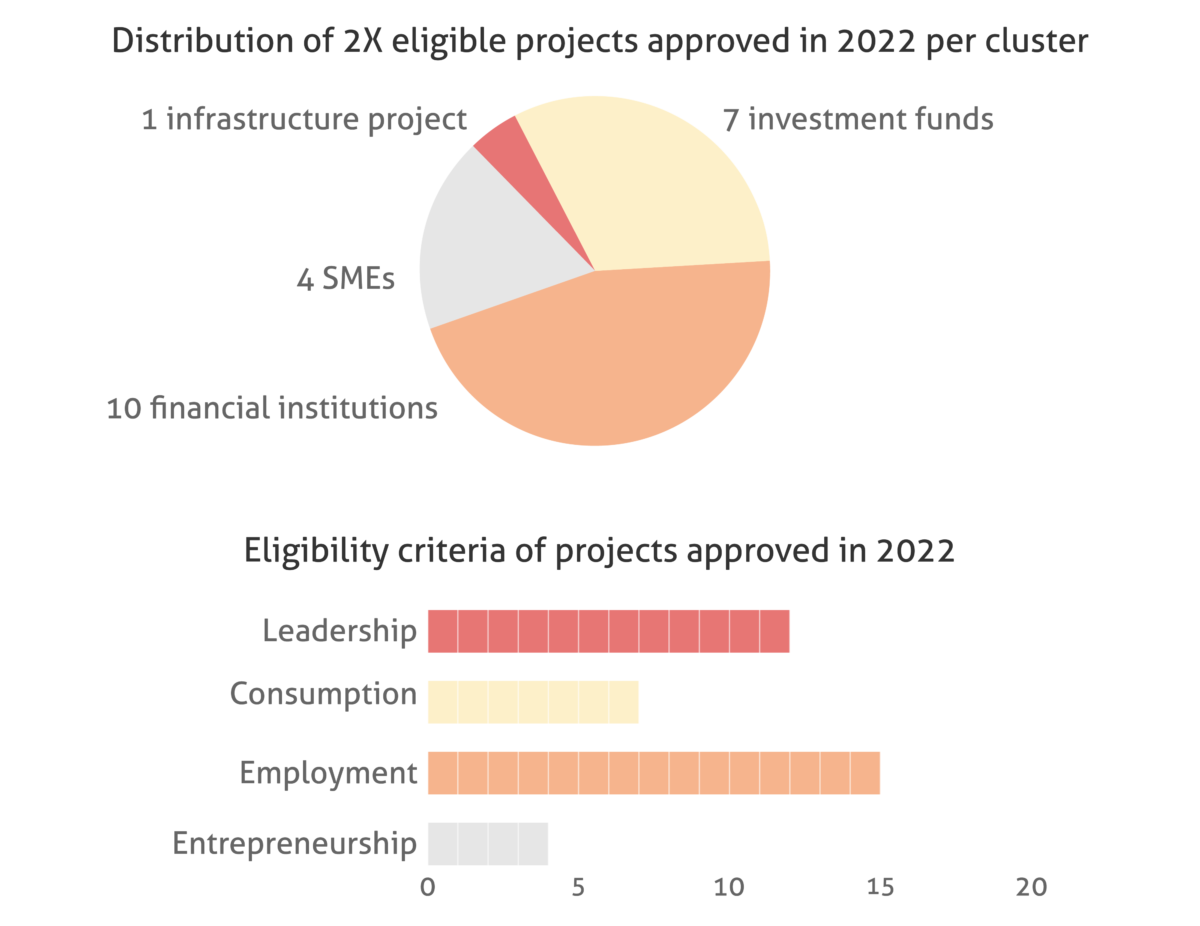

14 out of the 23 projects approved in 2022 invested in women and qualified for the 2X Challenge. Over the last three years, BIO contributed EUR 295 M to the 2X challenge – EUR 94 M in 2020, EUR 66 M in 2021 and EUR 135 M in 2022.

SDG7

Total electricity production supported of 4,656 GWh through direct energy projects and 1,117 GWh through indirect energy projects. BIO finances energy production to the equivalent of the annual consumption of about 16 million people, 90% of which in Africa. In 2021, the renewable energy financed by BIO avoided the emission of 660,000 tonnes of CO₂. Indirect projects avoided another 520,000 tonnes.

SDG8

Decent work and economic growth

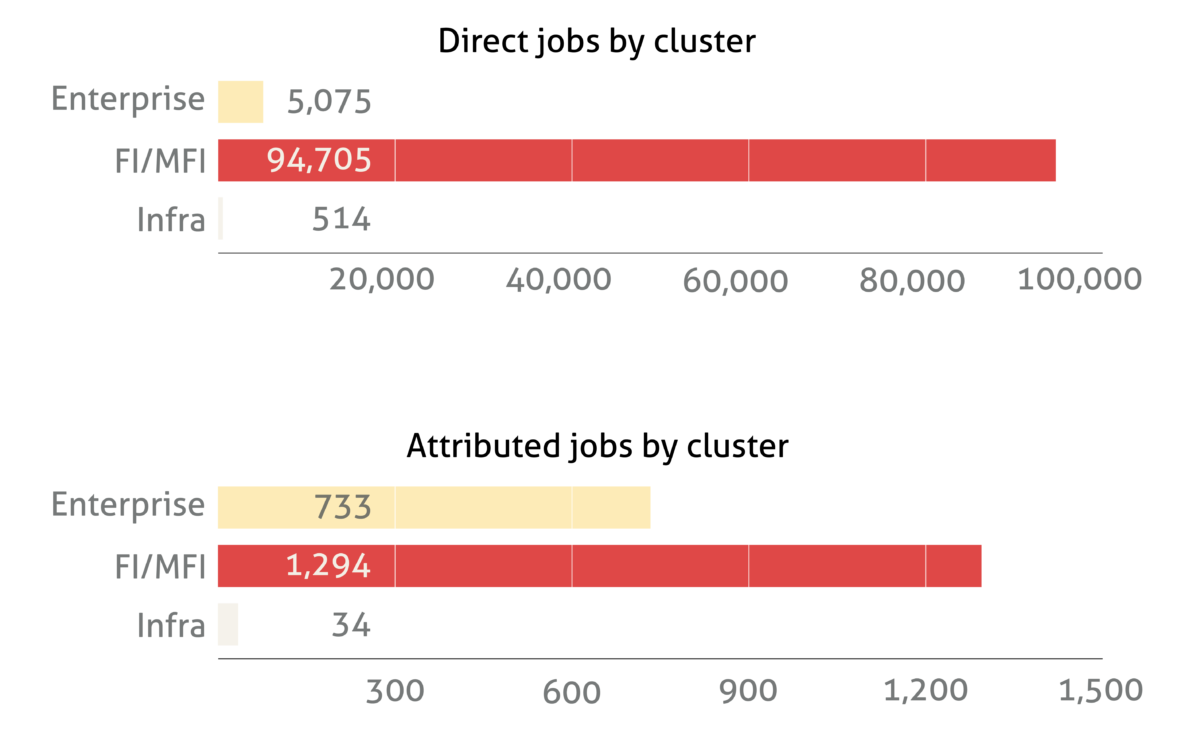

In 2021, BIO’s funding supported 100,294 jobs through direct investments and an additional 156,734 through indirect investments. Altogether, BIO's investment projects would support more than 6.7 M indirect jobs, as estimated through JIM. Financial institutions in BIO’s direct portfolio have EUR 53.2 billion outstanding in loans, with a strong focus on MSMEs. This is a 23% net increase compared to the previous year.

SDG9

Industry, innovation and infrastructure

BIO’s portfolio includes 8 direct investments and 59 indirect investments in manufacturing companies. In 2021, the 44 financial institutions funded by BIO granted at least 147,900 loans to SMEs, of which 72,100 to small companies and 75,800 to medium-sized companies. BIO finances 59 tech-related businesses through five venture capital funds that focus on tech companies in sectors such as ICT services, agriculture, health, and education.

SDG10

BIO’s outstanding investments in LDCs amount to EUR 122.9 M, corresponding to 22% of BIO’s total outstanding. The microfinance institutions that BIO funded directly had EUR 2.6 billion of microloans outstanding at the end of 2021, equivalent to more than 3.1 million loans to micro-entrepreneurs. In 2021, companies funded by BIO paid EUR 537.2 M in taxes to their respective local governments. Funds’ investees are the source of an extra EUR 423.4 M in tax revenue in that year.

SDG12

Responsible consumption and production

All the 2022 approved direct investments in the agricultural value chain work with international sustainability certifications such as Fairtrade, Organic, or Rainforest Alliance. In 2021, two financial institutions directly funded by BIO offered more than 2,700 green loans for a total outstanding amount of more than EUR 1.1 billion.

Data disclaimer

The data are gathered through self-reporting from clients on a selected number of indicators using a standardised template. There is a one-year lag due to the time required for clients to provide yearly figures, and for BIO to verify, consolidate and analyse these data.

Most figures are based on data reported by project companies and aggregated on a portfolio level. These are non-attributed figures and do not take BIO’s investment share into account. In other words, they capture the entire activity and development effects of the funded companies. BIO continuously aims to improve its data collection and reporting on the development effectiveness of its investments.

This publication is based on the 115 reports (out of 118 expected) submitted to BIO. Another 20 projects are not included in the reporting because they are in distress or exempt from reporting.

In 2022, BIO signed new investment commitments in 23 projects, for a total of EUR 225 M. In all newly approved projects BIO will be financially additional, and for 19 of them BIO will be non-financially additional through the reinforcement of ESG risk management strategies and policies of the investee companies, most commonly with the support of the Business Development Support Fund.

Gender equality

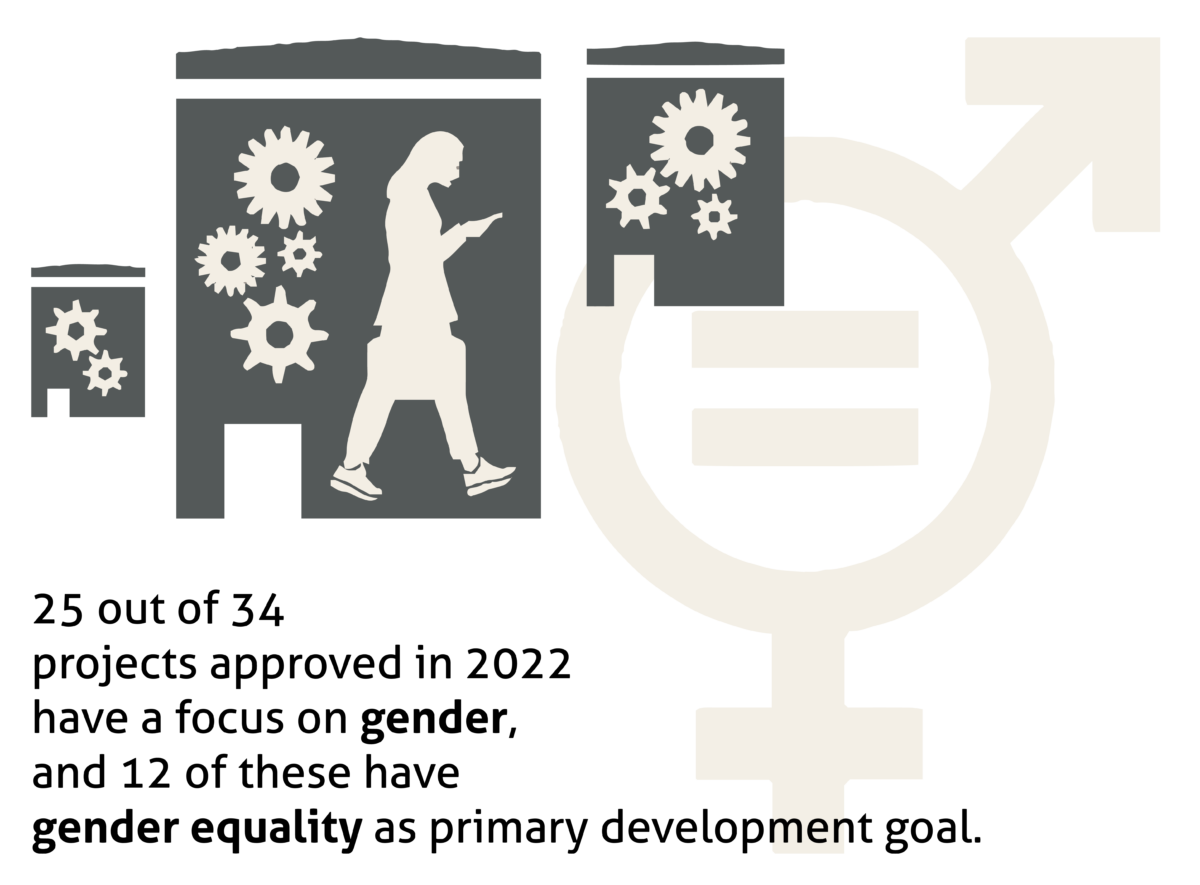

Gender equality is a fundamental human right and is integrated in all BIO's projects, strategies, policies, and actions.

Despite some progress in recent years, according to the UN gender inequality index, no country in the world has achieved full gender equality, nor are they expected to achieve it before 2030. Despite being the numerical majority, women are a minority in leadership positions and politics all around the globe. Because of increased household burdens and heightened risk of violence, they are also usually affected the worst by crises, such as the pandemic or climate change.

Since such gender inequalities pose a real barrier to sustainable and inclusive development, and could seriously harm the businesses themselves, Development Finance Institutions like BIO have intensified their efforts to reduce them.

For BIO, gender equality is a fundamental human right. Since 2018, the topic of gender justice has been increasingly integrated in its strategic thinking and in all of its operations. Beyond merely increasing the number of female employees or clients of a company, BIO’s gender strategy focuses on empowering women by enhancing their economic opportunities. To create these opportunities, BIO has adopted a 360° gender lens, to look at gender from all angles, considering all the roles women can have in a company: entrepreneurs, leaders, workers, consumers, and community members. This lens provides a framework to collect gender-related information, evaluate key dimensions of gender equality, and engage with clients on gender-related issues.

By supporting its partners empower women in their workplace, value chains and stakeholder network, BIO contributes to tackling gender inequality, one of the major barriers to sustainable development.

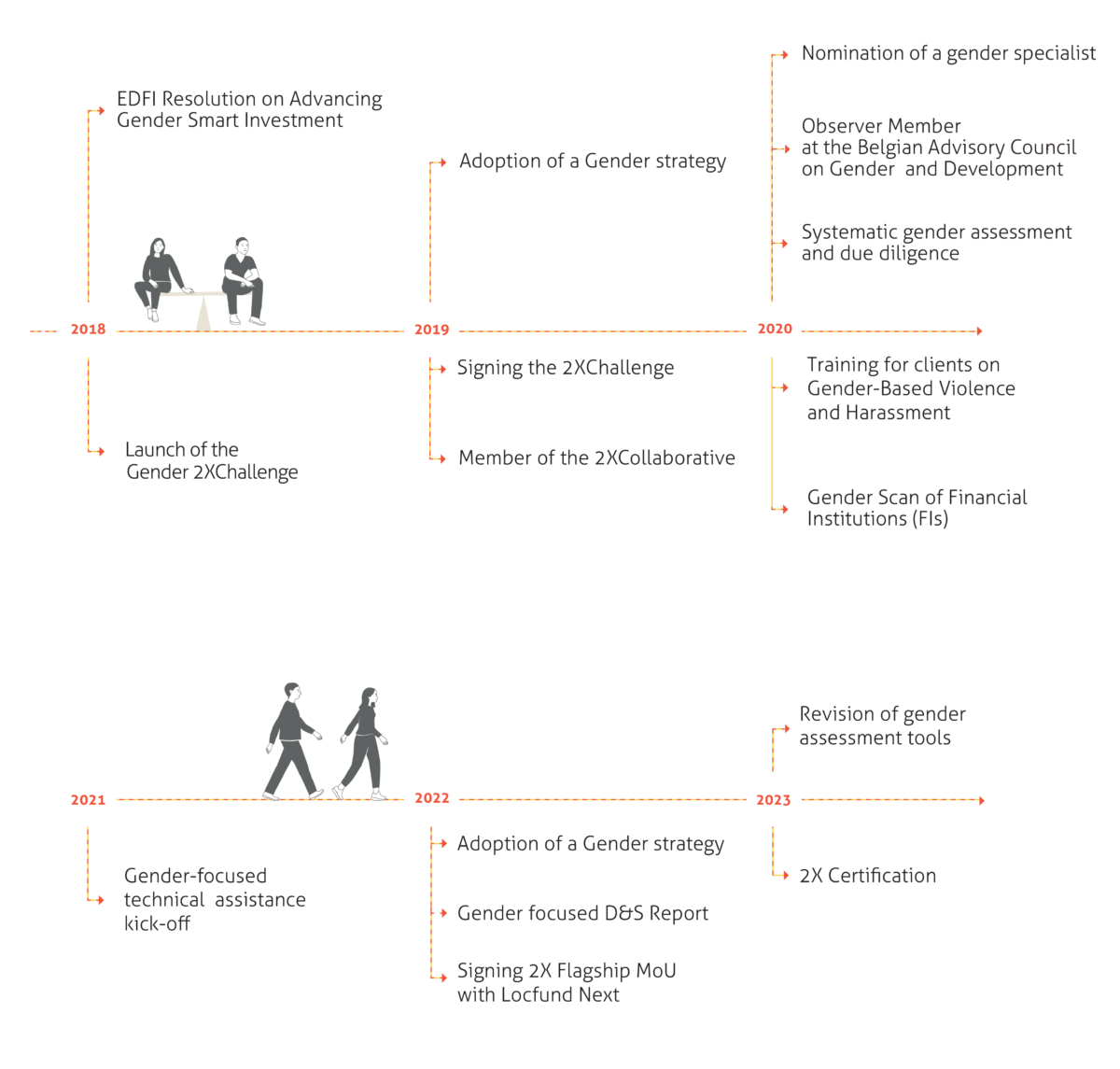

Timeline of major gender equality steps at BIO

Partnership for the goals

BIO is a member of 2X Global, a global organisation dedicated to unlocking gender-smart capital on a significant scale. It brings together gender experts from development finance institutions and other leading investors to support the development of shared financing principles, definitions and methodologies that promote the integration of gender-smart decision-making into investment processes and operations.

An essential part of this agenda is the 2X Challenge, an initiative launched at the G7 Summit in 2018 which seeks to inspire DFIs to concentrate their financing efforts on advancing women's economic empowerment and fostering gender equality. This challenge calls for directing resources towards initiatives that enable women in developing nations to access leadership opportunities, quality employment, financial support, enterprise resources, and products and services that promote the inclusion of women and girls.

Flagship Funds

In partnership with 2X Challenge participants, we created and maintain a now-widely-recognised label for gender-smart funds whose fund managers make ambitious commitments to gender targets at both the fund manager and the portfolio level. Flagship Funds are nominated and then awarded special recognition by an independent 2X committee of industry leaders.

2X eligibility

To qualify for the 2X Challenge, a client must formally (commit to) achieve at least one of the following criteria:

- Entrepreneurship – The business is founded by a woman who still maintains an active role OR holds more than 51% in shares.

- Leadership – 30% of women are in senior management OR 30% sit on the board or the investment committee.

- Employment – At least 40% of employees are female AND a policy or programme is in place to address barriers to women’s quality employment (beyond those required by local law or compliance).

- Consumption – The company provides products that address women’s unique needs, address a problem disproportionally impacting women, or that have a majority of female customers or beneficiaries.

For each new potential project, BIO assesses its potential impact on gender equality by examining existing policies and strategies, and by determining its eligibility for the 2X Challenge. This evaluation helps gauge the investment's expected contribution to promote gender equality. The 2X criteria have been updated by 2X Global and today (2023) are being integrated in BIO's procedures.

Out of the 22 2X eligible projects (for a total amount of EUR 180 M) approved last year, most projects scored well on the leadership and employment criteria, while half of the projects approved in 2022 qualify on at least two 2X criteria.

Northern Arc India Impact Fund

In November 2022, BIO invested INR 650 M in the Northern Arc India Impact Fund (NAIFF), a private debt fund focused on India. BIO is the first DFI to invest.

NAIIF has adopted a Gender Lens Investing Framework, integrating gender considerations in its credit and underwriting process. The framework includes a gender equality policy, procedural guidance on how to apply it, and the instruments and tools to do so.

NAIIF meets all 2X criteria, confirming its dedication to advancing women's economic empowerment and fostering gender equality.

- Entrepreneurship: One of the founding members of NAIIF is Ms Fernandes, who retains an active role in the company.

- Leadership: Two out of five members of the investment committee and 45% of the senior management are women.

- Employment: Six out of the 14 employees of the fund are women, and there are many policies and initiatives in place supporting gender equality at work.

- Investment through financial intermediaries: 35% of the fund’s portfolio is invested in companies that have a focus on gender and/or are led by women, and all MFIs targeted by the fund have 100% female clientele.

Ms Rajani Srichandana, a farmer's wife from a rural family of ten, experienced a remarkable transformation with the support of Annapurna Finance, an investee of the Northern Arc India Impact Fund. Previously relying solely on farming income, Rajani's life changed when she received financial literacy trainings from Annapurna. Empowered by this knowledge, she secured loans to start a grocery shop and invest in a dairy business. Now, she owns fourteen cows that produce 100 litres of milk daily, and Rajani's family thrives since they no longer have to depend on local moneylenders thanks to the collaborative efforts of Annapurna Finance and the Northern Arc India Impact Fund.

Kashf Foundation

Kashf Foundation is a microfinance institution in Pakistan dedicated to fostering women's empowerment amidst the unique challenges of the Pakistani context. Kashf stands out among its competitors, it’s recognised for its exceptional gender-focused strategy and provision of non-financial services. To further support its mission, BIO has granted a USD 10 million loan to this transformative MFI.

Kashf Foundation serves an active client base of approximately 500,000 low-income microentrepreneurs. The institution primarily offers individual loans with an average ticket size of USD 330, repayable over a twelve-month period. Almost all of Kashf's clients (99.8%) are women, with 60% of them first-time borrowers.

Kashf provides community developing training to raise awareness, break cultural barriers, and build capacity to effectively address gender-related challenges. In 2020, more than 12,500 individuals took part. In total, nearly 36,000 women have benefited from empowering training sessions on leadership, counselling for victims of violence, and women's rights education.

As a teacher, Deena adorned her home with handmade treasures from her hometown, Sindh. Encouraged by the people who saw them, she started a business to bring these unique pieces to everyone’s home.

Today, she proudly runs an online business, sourcing unique creations from talented artisans in Sindh. Each piece carries the essence of her culture and heritage, connecting hearts worldwide. Her children witnessed her struggles, but they also saw something greater: a role model who never gave up.

Kenya Commercial Bank

In 2022, a BDSF subsidy enabled the Kenya Commercial Bank (KCB) to develop a digital platform that offers business tools, virtual trainings, and a space for knowledge sharing between female business owners. Through this platform, KCB aspires to foster a vibrant ecosystem of networking opportunities and to facilitate positive spill-overs for its female clientele.

More and more BIO investments have gender equality at their very core: 35% of the 2022 portfolio of direct projects (versus 18% last year) had gender equality as a primary development goal and 38% as a secondary goal.

More than one third – 36,662 jobs – of the total direct jobs supported through direct projects are occupied by women and 48,979 extra female jobs are supported through the funds' investees.

More than one-fourth of microfinance institutions in BIO’s portfolio have a strong focus on female microcredit clients, who on average represent 83.2% of their clients.

In 2022, two Technical Assistance projects supported by the Business Development Support Fund had a strong focus on gender equality.

Affordable and clean energy

Investing in renewable energy and supporting its affordability is vital to ensure energy for all. Expanding infrastructure and upgrading technology encourages growth and helps the environment.

A lack of access to reliable energy is a major constraint to economic growth and development. At the same time, fossil-fuel energy production and consumption are major contributors to climate change. To reconcile these conflicting challenges, BIO invests in renewable energy and energy efficiency projects.

Promoting clean and affordable energy requires tremendous public and private investments in energy infrastructure and climate finance. Estimates exceed EUR 1 trillion annually up to 2030. Because the energy sector creates a lot of jobs and economic development, these enormous investments indirectly help to reach other SDGs as well.

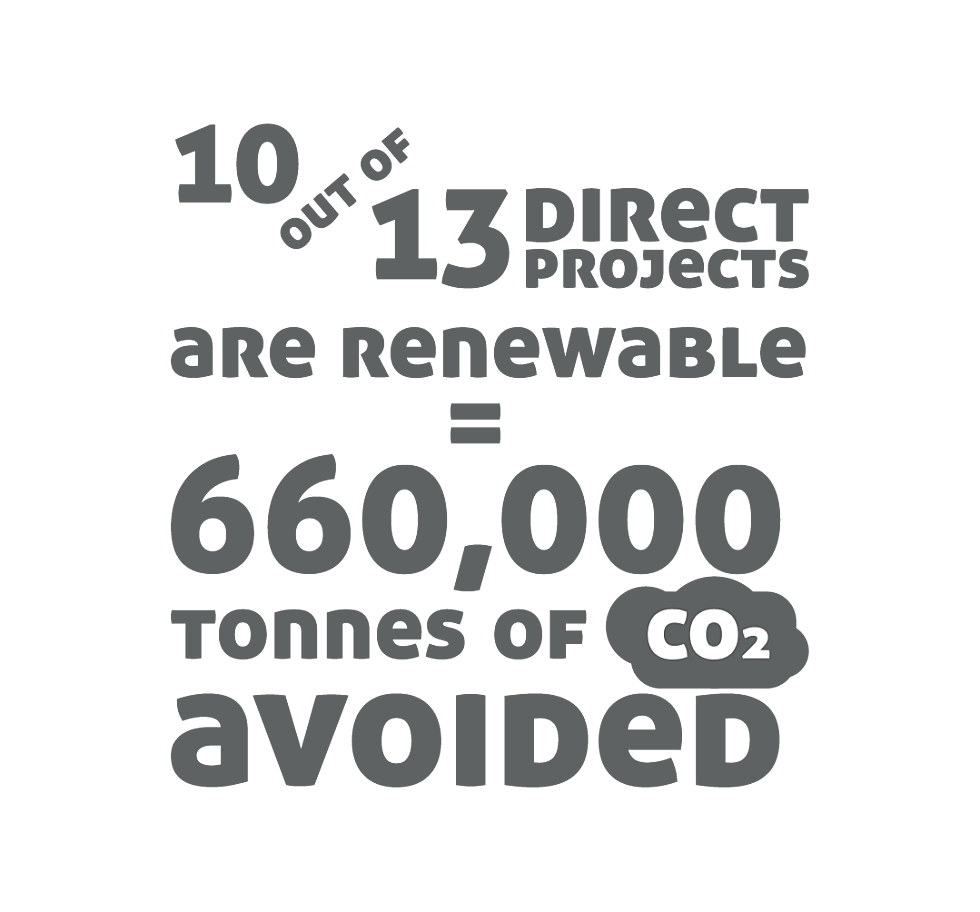

BIO has 13 direct investments in energy production facilities in its current portfolio. The total installed capacity of these projects reaches 1,453 MW. In 2021, they produced 4,657 GWh, an amount that would cover the annual energy consumption needs of about 15.1 million people. Ten are renewable energy projects that include geothermal, hydro, wind, and solar energy. They represent 26% of the total energy produced by BIO's direct energy projects and avoid the emission of 660,000 tonnes of CO2 annually. That is almost equal to the annual CO2 emissions of more than a million people in Ghana.

In addition to these direct investments, BIO has 59 indirect investments in energy-related projects. More than two thirds of these were production facilities, funded through 11 investment funds that focus on energy and energy efficiency projects. The other projects deal with the transmission and distribution of electricity. Together they have an installed capacity of 1,143 MW. In 2021, they produced 1,117 GWh of electricity. This is sufficient to cover the consumption of 1.2 million people in the countries of production and avoids the emission of 520,000 tonnes of CO2.

Increased availability, higher reliability, and lower prices for energy have large economy-wide effects as well, which include support to local jobs, added value, and opportunities for a modern and green industry.

BIO is fully committed to promoting renewable energy, but does not necessarily exclude investments in innovative gas projects, only when justified by the local context and in line with national long-term low emission development strategies. The three direct non-renewable energy projects produce reliable and cheaper electricity by using more efficient combined-cycle gas turbines. They are also cleaner than the locally available coal or diesel alternatives. However, in line with the EDFI Climate & Energy Statement, BIO will exclude all fossil fuel investments by 2030 at the latest.

A successful exit

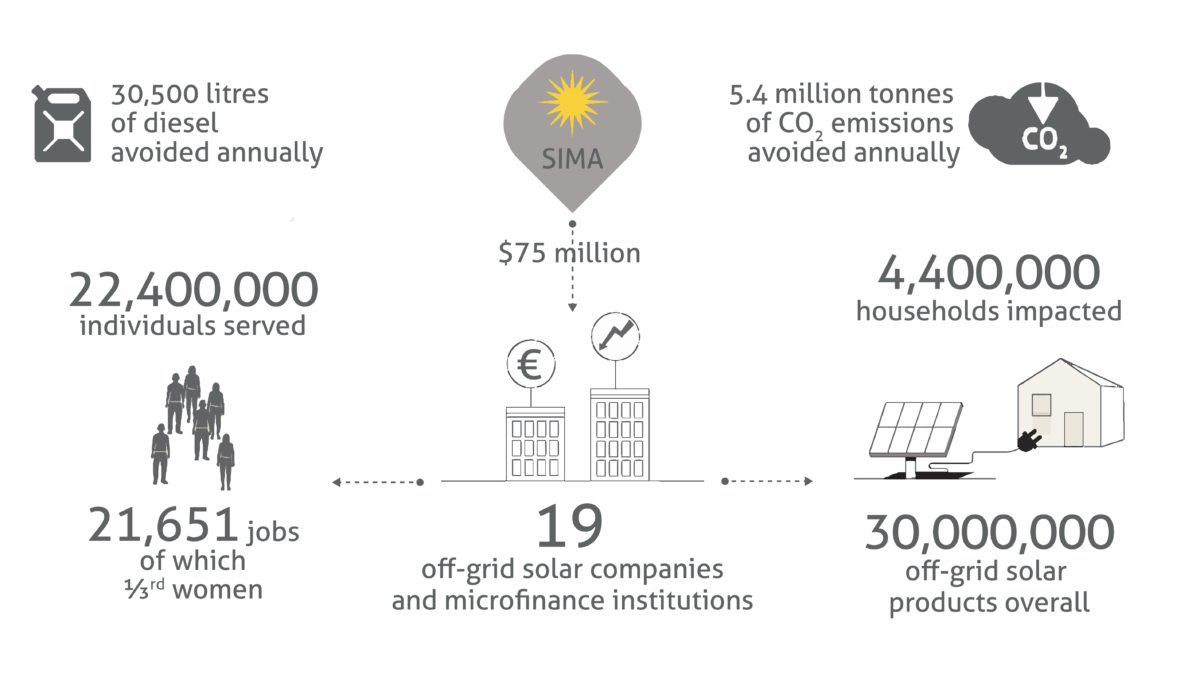

Worldwide, there are still 940 million people who have no access to electricity. Off-grid solar systems could give hundreds of millions of them access at a more affordable cost. That is why SIMA, one of the largest investment funds in the off-grid solar sector, provides senior debt to innovative companies that finance, manufacture, and/or distribute individual solar home systems in sub-Saharan Africa and South Asia.

BIO has successfully exited its investment in SIMA’s Off-Grid Solar and Financial Access Fund, a 5-year closed-end investment fund focused on photovoltaic renewable energy solutions and access to solar home systems.

The fund ultimately invested USD 75 million in 19 off-grid solar companies and microfinance institutions. These provide access to energy to the poorest socio-economic groups and created 6,275 jobs, of which 30% occupied by women.

Overall, investees of SIMA have provided clean energy for over one million beneficiaries. It is estimated that SIMA’s portfolio companies avoided more than 6 million tons of CO2 emissions.

Over the investment lifetime, the E&S risk management of the fund has improved: SIMA has developed an ESG policy that includes an E&S risk assessment during Due Diligence phase, encouraging the borrowers to monitor E&S risk throughout the investment period, and more generally, it has demonstrated intent and willingness to measure its effectiveness in terms of social impact. This has been evidenced by SIMA’s active engagement in GOGLA, the global association for the off-grid solar energy industry.

Having access to clean, affordable and secure energy is a challenge in many of BIO’s countries of operation. When faced with a shortage of electricity, you can either increase your production or reduce your consumption. That is why BIO supports energy efficiency projects that reduce energy consumption by replacing obsolete equipment for newer, more efficient versions.

Cooking over open fires or inefficient stoves typically entails burning fuels such as wood, charcoal, coal, and kerosene that release harmful GHG emissions. Highly efficient cooking stoves use 30-60% less fuel, reducing forest degradation, deforestation, and climate change. This is what BIO contributes to through investments in clean cooking value chains e.g., Spark+, Xpress Gas.

XpressGas’s biggest competitor is the charcoal industry. About 35% of Ghanaian households still use charcoal to cook, and the Greater Accra and Ashanti regions combined consume over 50% of all the charcoal used in the country. While people in the countryside gather wood in their backyards or in the bush and burn it on an open fire, people in peri-urban areas don’t have that option. Instead, they rely on charcoal imported from the countryside.

In some specific contexts, replacing wood and charcoal with gas is the most effective way to reduce greenhouse gas emissions in the short term. Using gas for cooking instead of firewood decreases CO2 emissions by about 60% and, furthermore, reduces the need to cut trees for firewood, one of the world's most important causes of deforestation.

In addition to the energy produced from fossil fuels or from renewable energy sources, there’s the energy locked into agricultural by-products or waste. By burning or digesting these under strictly controlled circumstances, we can recuperate energy that would otherwise have gone to waste. That is why BIO is also willing to invest in Waste-to-Energy facilities and will encourage its other clients to look for solutions for their by-products and waste streams.

In adherence to both national laws and applicable international standards, every power project funded by BIO must rigorously comply with stringent guidelines. To ensure the highest level of best practices, measures are instituted during both the construction and operational phases of these projects. This includes implementing an E&S impact assessment, prioritising local hiring practices, formulating community investment plans, and appointing dedicated personnel responsible for health and safety management, community liaison, and environmental studies and monitoring.

One of the issues frequently encountered in the energy sector is the uncertainty regarding the solar value chain.

Solar value chains

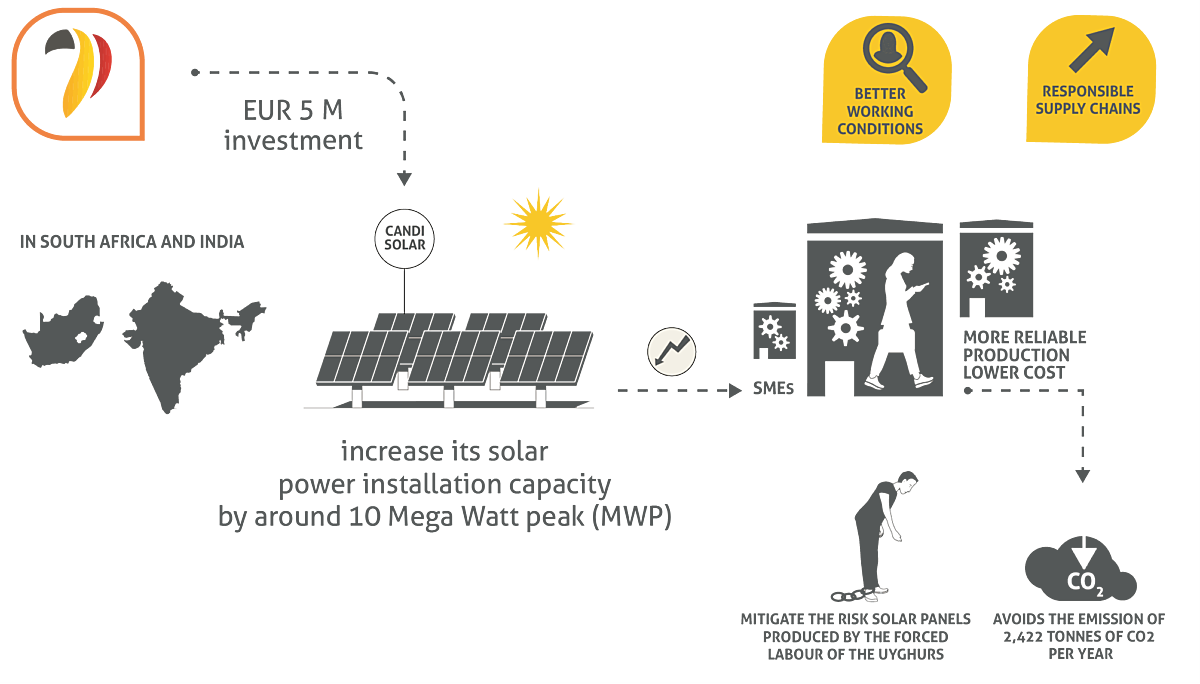

Over the past year, there have been increasingly alarming reports about forced labour concerning the Uyghur minority in China in the solar panel production. This raises many questions about how to deal with the risk of investing in projects involving solar panels.

Today, the social risk of investing in the solar value chain represents a big challenge, to be addressed with increased awareness and long-term commitment towards alternative value chains.

BIO vehemently condemns any use of forced labour in its investment projects and in their supply and off-taker chains, and will communicate this position in all relevant relations with (potential) clients and other stakeholders. BIO favours the creation of fully transparent alternative solar panel supply chains so that any risk of forced labour can effectively be excluded. BIO will keep itself informed on the development of such alternatives and will support them with investments and technical assistance.

Moreover, BIO seeks to align itself with European DFIs, IFC and the World Bank Group on a joint policy to address the risk of forced labour in solar panel supply chains.

candi solar

In 2022, BIO has granted an additional USD 7 M loan to candi solar, a company installing, owning, and operating solar production plants in India and South Africa. The investment follows on a first intervention in 2020, when BIO granted the company USD 5 M.

In addition to BIO’s investment, responsAbility – a leading impact asset manager who designs sustainable investment products - co-financed USD 7 M. This will further support candi solar's increasing capacity: they reached 32 MW in operation at the beginning of 2022. A technical assistance project has also been granted by BIO aimed to upgrade candi’s credit scoring tool.

Total electricity production supported in 2021 of 4,657 GWh through direct energy investments and 1,117 GWh through indirect energy investments

BIO finances energy production to the equivalent of the annual consumption of about 16.3 million people. More than 90% of the people using electricity produced by BIO projects live in Africa.

Ten out of BIO’s 13 direct energy projects are renewable and BIO invests indirectly in 59 other energy facilities, all but 3 renewable.

In 2021, the renewable energy financed by BIO avoided the emission of 660,000 tonnes of CO2. Indirect projects avoided another 520,000 tonnes.

Decent work and economic growth

In a context where many countries struggle to achieve SDG8, BIO places decent work as a central objective: as part of its mandate, it aims to support more, inclusive, and better jobs.

SDG8 calls for the promotion of inclusive and sustainable economic growth, employment and decent work for all.

Jobs and economic growth mainly rely on the dynamism of private entrepreneurs: their role is crucial to ensure that jobs and economic growth also benefit more vulnerable groups. One of BIO’s main priorities is to support its clients to expand these economic activities, and to create formal, quality employment for the local population. This is well illustrated by BIO’s recent investments in Inka’s Berries and in Uhuru Growth Fund I, both of which are expected to have a significant impact on local economic growth. Another great example is BIO's indirect investment in Congo Call Center, which is the first introduction to the job market for many.

"In general, young people find it difficult to find their first job because they lack experience. Thanks to Congo Call Center, they have the opportunity for a professional experience of two years, where they pass through a basic customer service training, and acquire job discipline and punctuality, which is essential in the sector. A job in a call centre is very demanding and asks for precision, the performance indicators need to be respected. Courtesy, politeness, a smile, and discipline are key to succeed in this job because revenues are generated through productivity.

While at first, they hate the required discipline, after a while, they realise that all these tools are necessary in their future careers, and they are happy with the experience. When they leave to find a job elsewhere, they’re different people.

You can only work in a call centre for two to three years. That’s why we created an incubator called Ingenious City to support our employees and help them become entrepreneurs. We train them and help them find financing. We have a programme with Orange Corners - an initiative of the Dutch embassy - which finances the incubation of fifty emerging enterprises a year."

Ms Annie Tuluka, managing director of Congo Call Center

Importantly, economy-wide effects also create many jobs indirectly. JIM estimates suggest that in 2021 companies directly funded by BIO supported a total of 5.6 million indirect jobs. Most of these were created by loans from financial institutions (5.3 million). The remaining jobs come with the local purchasing of intermediary goods and services (140,000), wages spent in the local economy (370,000) and on energy (170,000). The investees of the funds in which BIO is invested would indirectly support an extra 1.1 million jobs.

Challenges and opportunities

Labour markets in emerging and developing countries are often poorly regulated. Many jobs are informal, with a lot of casual workers. Wages are generally low and working environments unsafe. Companies’ internal policies are sometimes poorly designed and may have a bad impact on the condition of workers.

That leaves a lot of room for improvement. Consequently, BIO assesses the labour employment and management practices of its potential clients and, in line with its environmental and social policy, requires clients to promote a fair, safe, and secure working environment.

Clients must adhere to all relevant local and international regulations, including the core conventions of the International Labour Organization (ILO). BIO’s reference standard with respect to working conditions is IFC Performance Standard 2. Its investment contracts require its clients to work towards achieving these E&S standards over time.

By promoting sustainable and fair employment creation, BIO ensures decent working conditions and safeguards the basic rights of workers.

The concept of Decent Work developed by the International Labour Organisation (ILO) implies an integrated approach to development and economic growth that takes both the quantity and quality of jobs into account.

In January 2023, BIO’s board of directors approved the decent work policy that aims to clarify the concept, as well as how BIO integrates it throughout its activities.

The policy provides an introduction to the challenges faced in developing countries and states how BIO addresses them through investments, namely by adhering (and ensuring the client and its clients adhere) to

- IFC Performance Standard 2,

- the local laws and the ILO Core Convention,

- the Declaration on Fundamental Principles and Rights at Work, and

- the Basic Terms and Conditions of Employment.

The policy digs deeper into BIO’s requirements and due diligence assessments on the different aspects of decent work and focuses on BIO’s approach with regard to wages, thus explaining how BIO directly contributes to SDG1 (a world with no poverty).

Financial services

BIO invests in companies to stimulate economic growth, innovation, productivity, and financial inclusion. Also, by investing in financial institutions, BIO improves access to financial services for entrepreneurs. Financial services such as savings, insurance, payments, and credit, allow people to manage their lives, grow their businesses, and improve overall prosperity. Investing in financial institutions also has a significant direct impact on job support and creation: 63% of the jobs directly supported by BIO are in FIs or MFIs.

Inka's Berries

In October 2022, BIO committed to invest USD 15 M in Inka’s Berries, a Peruvian company that produces and commercialises blueberry bushes and fresh blueberries for export.

Inka’s Berries aims to incorporate 200 ha of land owned by the Peasant Community of Chambara in the Peruvian coastal region and to transform it into a productive area. The project should create approximately 200 permanent jobs and 1,000 seasonal hirings under formal contracts and good working conditions in this remote area with limited economic opportunities. The community will be paid under an established dividend distribution plan and will have preferential access to jobs and annexed activities generated by the project, other than benefitting from infrastructure improvements deriving from the company’s activities in the area.

The Environmental and Social Action Plan (ESAP) focuses on creating a trusting relationship between the Chambara community and Inka’s Berries: the action plan is expected to serve as a template for future community engagement with Inka’s Berries’ other projects.

Agroserv Industrie

A good example of how BIO’s investments can support substantial improvements in HR management and working conditions is the case of Agroserv Industrie, a Burkinabe maize milling company to which BIO granted a EUR 3 M loan in 2022.

Agroserv is proactively structuring the upstream national agricultural value chain, and provides technical and financial support to a large network of small producers and farmer organisations from which it purchases raw materials. They aim to develop a new agri-food transformation plant to increase their processing capacity and efficiency, which will increase the number of employees by 20% and will create and support additional jobs upstream and downstream. This will mainly benefit the rural population and the local stakeholders, like the small growers involved in the production of maize and soy, the herders who will access additional bran to feed their animals and develop their activities, the equipment suppliers, and the local traders of grains as they will have access to more cereals to trade.

An action plan for further improvement

BIO and Agroserv agreed on an ambitious action plan to improve the working conditions and procedures in the company. Agroserv will design an HR manual and upgrade their internal regulations to ensure that all practices are aligned with local legislation as well as the requirements of IFC PS 2. The company has standardised the employment of temporary workers through collaboration with a third-party agency. Finally, it has included provisions on respecting labour legislation in their supplier contracts.

An external expert is carrying out a health and safety audit of their existing plant. Agroserv has put in place a committee to oversee any health and safety risks, and to set up first aid procedures, roles and trainings.

Technical assistance

In November 2022, BIO approved a EUR 43,924 contribution to Agroserv to implement a 32-month technical assistance project to establish an HR function using a participatory approach, in collaboration with the interim-HR manager and in line with the needs identified in the ESAP.

The project started in June 2022 and is expected to finish in December 2024. Thanks to an external HR consultant, Agroserv will be able to identify the key objectives of the new HR function and will be guided through the set-up of the function.

This will be important to improve the company’s internal policies, operations, and practices linked to governance and resource management, as set out in the ESAP. The goal is for the new HR department to become properly equipped and capable of attracting and retaining the right talents, which is necessary for Agroserv to sustain itself and meet its growth objectives.

The Uhuru Growth Fund I

In 2022, BIO invested USD 8 M in equity in the Uhuru Growth Fund I, a private equity fund seeking to invest in high-growth companies across the Economic Community of West African States. It is managed by an emergent, solid and credible first-time fund manager in West Africa.

The fund aims to invest equity in small and medium-sized companies in the consumer-facing and financial sectors, to support their institutionalisation and growth, other than their expansion in neighbouring markets.

The focus sectors have a strong potential to enable employment and growth: the fund is expected to support at least 3,000 direct jobs and contribute to the creation of 1,000 fair and decent jobs.

Uhuru has a hands-on approach to value creation, with a strong emphasis on enhancing the operations of portfolio companies, enabling internationalisation and thus contributing to cross-border development and import substitution. Uhuru is committed to making responsible investments to create sustainable, long-term value for all its stakeholders by reducing the E&S risks and maximising the value creation potential and development impact in their portfolio companies.

The 7 new direct projects that enter the portfolio in 2021 add up to 13,341 jobs to the number of direct jobs supported by the BIO portfolio.

At the end of 2021, the total outstanding loan portfolio of financial institutions directly funded by BIO amounted to EUR 53.2 billion (corresponding to 197.5 million after attribution). A 23.0% net increase compared to 2020.

A large majority (94%) of the total direct jobs supported are in financial institutions while most of the remaining direct jobs supported (6%) are in direct investments in enterprises. However, when looking at attributed figures, more than a third (36%) of directly supported jobs are in enterprises.

Financial institutions reported a total of EUR 44.5 billion in saving deposits, and a large number of commercial branches (4882), of which 53% were in Asia.

Industry, innovation and infrastructure

Industry, innovation, and infrastructure are fundamental for developing countries, they generate employment and income for a dynamic economy.

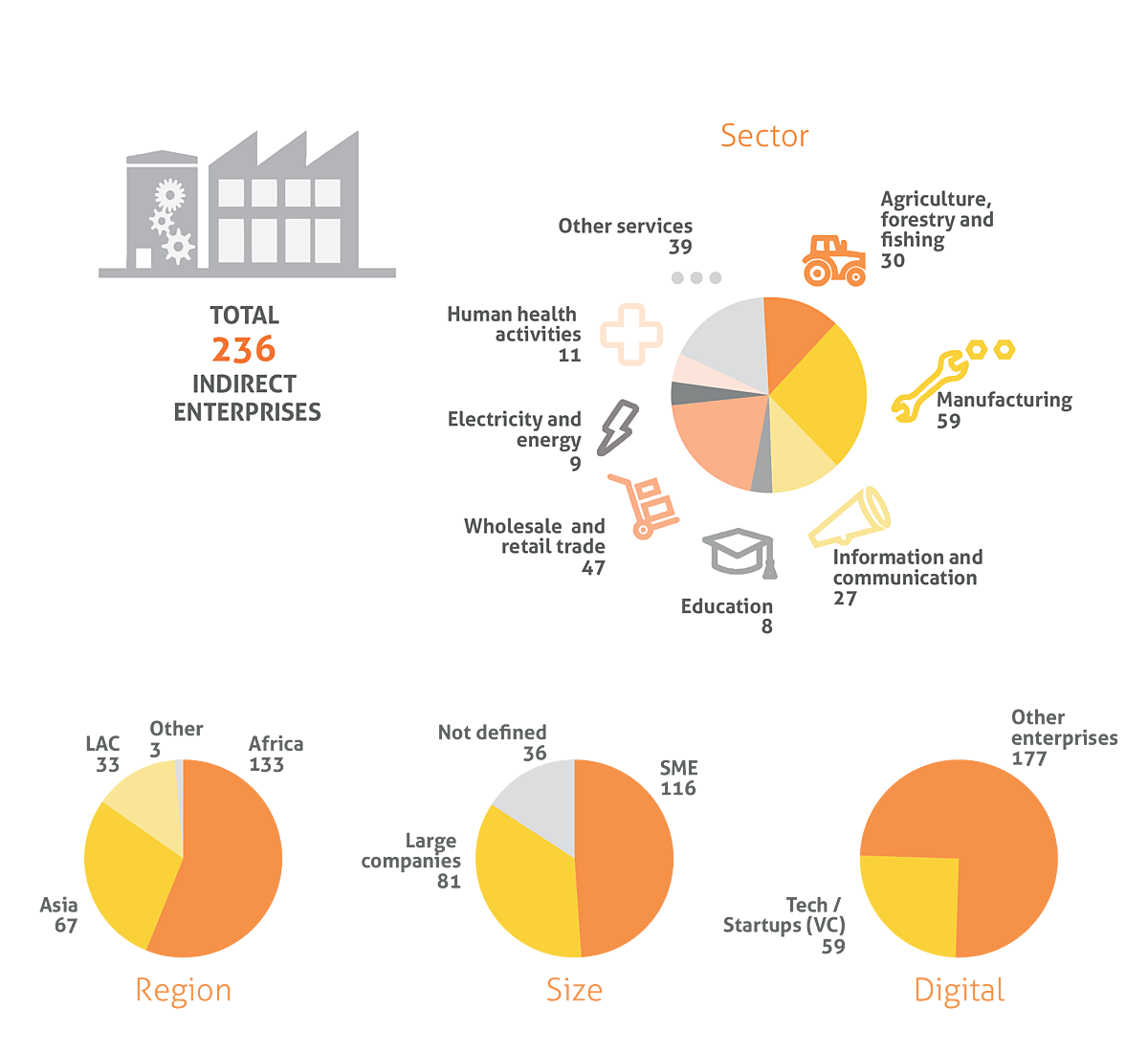

Manufacturing, technology, agriculture and digital innovation are key sectors for BIO, since they represent the backbone of a dynamic and resilient private sector. BIO indirectly invests in 236 enterprises, among which 59 manufacturing companies and 36 ICT or energy projects. A fourth of its investees are tech-related or digital startups, financed through venture capital funds.

Twelve of the 23 new investments that were approved in 2022 have private sector innovation and SDG9 as a primary goal.

SMEs have trouble finding financing, especially long-term capital, in emerging markets. For smaller and more informal businesses, this is even more difficult.

BIO’s financing contributes directly and indirectly to the growth potential of these companies. It is currently directly invested in 18 SMEs that are active in the manufacturing sector or the agricultural value chain.

Victoria Commercial Bank

In 2021, BIO committed to invest USD 10 M in Victoria Commercial Bank, to support the growth of the SME loan portfolio.

VCB is a Tier III bank in Kenya, active in the country since 1987, that serves mostly SMEs (92% of the loan book), with lending and deposit products along with a high-quality service.

While the bank used to be more focused on the manufacturing sector, it’s increasingly active in other markets, especially the agriculture value chain. With its investments in the agriculture sector and partnerships with other actors strategically located in non-urban areas, the bank positively impacts rural development and contributes to increase the lending offer for smallholder farmers.

Moreover, VCB is very advanced when it comes to digital services and its ability to reach its clients. Victoria Commercial Bank has put in place very strong E&S practices with a very exhaustive E&S policy and manual, implemented by a knowledgeable ESG officer, and demonstrates good practices to its peers.

BIO's indirect investments through financial institutions and private equity funds support a much larger number of SMEs in these sectors and others. BIO’s key objective when investing in financial institutions is to increase their loans and services to SMEs, and for them to provide the necessary market knowledge, product distribution channels, and support to these clients.

In 2021, the 44 financial institutions in BIO's direct portfolio granted at least 148,000 loans to SMEs, of which 72,000 to small companies and 76,000 to medium-sized companies. Private equity funds also provide long-term capital to enterprises. Moreover, these funds’ teams actively participate in the governance and strategic management of their investees, adding value, especially to relatively young companies and start-ups.

In 2021, BIO had a total outstanding amount of EUR 144.1 million in 47 investment funds. These are mostly SME-focused private equity funds that are active in Africa. Together they are currently invested in 236 companies, 131 (micro-)finance institutions and 59 (small-scale) energy infrastructure projects.

Financing SMEs has great potential for environmental and social improvements, but also poses risks. SMEs face challenges with respect to pollution, lack of permits, threats to biodiversity, labour issues, dangers to human health, and impacts on communities. It is therefore crucial to address these risks, to mitigate them, and to strengthen the sustainability of doing business.

Therefore, BIO works with its (prospective) clients to actively identify opportunities for improvements in the E&S performance throughout BIO’s investment period. The beneficiaries can call on BIO’s Business Development Support Fund to co-finance E&S related studies, evaluations, trainings, and third-party expertise.

Because of their nature, financial institutions and funds themselves usually don’t have a large direct E&S footprint. However, their clients and investees often do. That is why financial institutions and funds must insist that these develop and implement an environmental and social management system. BIO can provide them with technical assistance to support this effort.

Digital for Development

Digitalisation plays an important role in reaching the SDGs, and can catalyse companies’ efficiency and effectiveness, in particular in developing products and services for more vulnerable groups. That is why digitalisation for development is a key BIO investment objective.

As they are generally still in the start-up or early development stage, highly technological companies in developing countries with a strong digital component are often financed by specialised private equity funds. These funds usually focus on agritech, fintech or healthtech. They have environmental and social policies and management systems (ESMS) in place that ensure that E&S risks are assessed and mitigated at all stages of the investment process.

In 2022, BIO invested USD 4 million in equity in the Lendable MSME FinTech Credit Fund, following a loan in 2020. The fund aims to address the financial and technical needs of early to mid-stage digital companies in Africa and Asia. At BIO’s request, it added digital-specific E&S topics including data privacy and ethical use, and data security into its ESMS.

Finally, the Business Development Support Fund has grants available to strengthen the digitalisation of products, services, internal processes, staff capacity, and the protection of clients’ personal data.

Convergence Partners Digital Infrastructure Fund

CPDIF is another good illustration of how BIO supports funds to enable infrastructure for the digital economy across sub-Saharan Africa.

In 2022, BIO committed to invest USD 10 M in Convergence Partners Digital Infrastructure Fund LP, a private equity fund that invests in digital infrastructure and the ICT sector, with a focus on fibre, wireless, data centres, 5G and digital service provider platforms.

The fund’s investments help to provide a more reliable, affordable and accessible internet connection for businesses and the population, in South Africa, Nigeria, Ghana, and Kenya mainly, where such infrastructure is currently scarce.

The digital sector is highly impactful and crucial for private sector consolidation and innovation: telecom infrastructure represents the backbone and key enabler of the digital economy, thus being critical to the creation of many digital markets and to the improvement of many real markets. CPDIF has a strong focus on closing the digital inclusion gap and measures its objectives quantitatively: its investees report on several aspects, like broadband access, employment creation, taxes paid, kilometres of fibre laid, homes and schools passed, and number of towers.

One of the first investments of the fund was Ctrack, a leading telematics Software-as-a-Service vendor providing fleet management analytics, insurance risk solutions and asset tracking solutions in South Africa.

TIDE Africa

BIO invested in TIDE Africa I (Technology and Innovation for Developing Economies Africa I Fund) and in TIDE Africa II. They invest in venture capital (VC) associated with technology, innovation, and value generation in sub-Saharan Africa (emphasis on Nigeria, Kenya and South Africa) and in Egypt.

The fund manager is committed to promote ESG best practices: they have already adopted an environmental and social management system covering all steps of the investment cycle and are willing to further institutionalise their E&S practices with the support of the DFIs.

Through this investment, BIO supports the sustainable growth of the African VC ecosystem, enhances the innovation and development of the digital-based economy to provide innovative solutions to local problems, and supports the next generation of African entrepreneurs.

"The fact that there is much less capital (in absolute and relative terms) for tech in Africa, makes the entrepreneurs laser focused and extremely resourceful, efficient and agile when it comes to growing their startups.

The lack of infrastructure creates some challenges, such as the need to get involved in many parts of the value chain of each sector as the existing industries are less mature. On the other hand, it creates a fantastic environment for tech driven innovation."

Ido Sum, partner at TLCom Capital

Half of the direct investments in the manufacturing sector are in manufacturers of food products.

64% of the 59 indirect investments in manufacturing companies are in Africa and 34% in LDCs; 25.4% are manufacturers of food products.

Direct jobs in the manufacturing sector account for 65% of the jobs supported in enterprises directly funded by BIO and more than one-fourth of the 85,000 direct jobs supported in indirectly funded enterprises.

Manufacturing companies represent almost the half of BIO’s direct investments in enterprises and one-fourth of its indirect investments.

Out of 48 investment funds in BIO’s 2021 portfolio, 26 are SME or agri-value focused funds, eight target small scale infrastructure and/or the fight against climate change, and eight financial inclusion (mostly through MFIs). The remaining six are mostly venture capital funds targeting digital development.

BIO’s indirect portfolio includes 426 investment projects, 59 small-scale energy infrastructure projects, and 59 tech-related businesses that focus on various sectors such as healthtech, edutech or fintech.

Reduced inequalities

Through its strategies and operations, BIO seeks to foster a more equitable world and address disparities across various dimensions. Its contribution to reducing inequalities is a central subject and was extensively analysed and investigated by last external Case Study Evaluation.

SDG10 calls for reducing inequalities in income among and within countries, in addition to targeting inequalities on other factors such as age, sex, disability, race, ethnicity, origin, religion, or economic status. Inequalities continue to be a significant concern for developing countries despite progress and efforts to narrow disparities of opportunity, income, and power. Through its overall mission and specific interventions, BIO, alongside other DFIs, plays a significant role in reducing inequalities in income as well as in the above-mentioned other aspects, which, in turn, enables the realisation of other SDGs.

BIO seeks to address income inequalities between countries by investing in Least Developed Countries (LDCs) and fragile states, by enabling economic structural transformations stimulating employment, private sector growth and productivity, and by targeting inclusive businesses (e.g. microfinance institutions, smallholder finance, agribusiness with smallholders, gender-smart investment, off-grid power and solar-home systems, etc.). By triggering economic growth in low-income settings but also by directly targeting the bottom 40% of the population, amongst others through inclusive businesses, BIO’s interventions aim at supporting reducing inequalities within countries.

BIO is also combatting discrimination and inequality by supporting equal opportunity and protection for all the impacted stakeholders – including vulnerable consumers or communities – by promoting high environmental and social standards. This is done by imposing strong requirements regarding client protection, community health, safety and security, and land acquisition and resettlement.

Reducing inequalities between countries

The 2022 external evaluation focused on BIO’s contribution to SDG10 - reducing inequalities.

In December 2021, BIO had EUR 465 M outstanding investments in 89 enterprises, mainly in sub-Saharan Africa, and indirectly EUR 209 M, through investment funds, in 545 companies.

About one third (EUR 224 M) of its total outstanding portfolio (targeting 223 enterprises, i.e. 35% of BIO’s total indirect final beneficiaries) is in least developed countries (LDC) and so-called fragile states. This is significantly higher than other European development finance institutions and seeks to contribute to reducing inequalities among LDCs and more developed countries.

In total, 40% of BIO’s direct investment volume goes to businesses that contribute to reducing inequalities within countries, mostly in very inegalitarian countries.

About one third of the capital indirectly invested by BIO helps to substantially alleviate disparities within a nation. This mostly pertains to investments in agriculture, MFIs, and off-grid and community-based energy projects, as these businesses are more likely to engage the poorest people as staff members, suppliers, distributors, retailers, or consumers within their value chains, ensuring a wide impact.

Overall, the companies supported by BIO in LDCs and fragile states create or maintain around 29,000 jobs, providing a total of EUR 164 M in wages in 2021. These investments play a vital role in promoting economic opportunities and reducing inequality in these countries.

Five of the 23 investment projects that were approved in 2022 were in least developed countries, and 19 had financial inclusion, rural development or access to basic goods and services as a primary objective.

In BIO’s portfolio, 21 of the 71 directly funded companies, and 119 of the 426 indirectly funded companies, are in least developed countries. In 2021, these companies contributed respectively EUR 537.2 M and EUR 423.4 M in tax revenues to their local governments. This is crucial because governments have a major redistributive role with respect to social and economic inclusion, healthcare, and education. Taxes and social contributions from BIO’s clients enable them to honour these commitments.

As part of the independent evaluation on BIO’s contribution to reducing inequalities, some projects have been analysed in detail with a focus on their contributions to SDG10. This is the case for Ilara Health, an investee of TIDE Africa LP that provides diagnostic tools to small and ill-equipped primary healthcare providers in Kenya, as well as for Barnana, an Ecuadorian agriculture processing company that BIO supports through its investment in EcoEnterprises Partners Fund, and for Banco Solidario, an Ecuadorian microfinance institution that focuses on financial and social inclusion.

The study shows that BIO has a clear focus on reducing inequalities, but would benefit from adopting a more explicit approach in the future - which we are now actively working on.

Ilara Health

While the Kenyan healthcare ecosystem counts many small providers, quality healthcare is either unaffordable or unavailable for the low to middle income population. That is why, in 2019, Ilara Health started to equip a network of ill-equipped primary healthcare providers in Kenya’s suburbs with lifesaving and essential diagnostic tools to improve the quality of medical care provided. The clinics supported by Ilara are decentralised and mostly present in peri-urban agglomerations, including poor suburbs and townships. Ilara reaches low to middle income patients who live with 5 to 10 dollars a day. 58% of its patients are women and about 20% are younger than 5 years old.

Since 2019, Ilara has increased its product range to quality medications, non-diagnostic equipment, and digitalisation services for the clinics’ information systems; they are now looking to expand geographically in Africa, starting with Ghana.

To support this expansion, Ilara has raised funding from multiple investors, including the Tide Africa Fund, in which BIO has invested. TLCom, the fund manager of the TIDE Africa Fund, assists Ilara by joining its board and by providing financing and helping in raising patient capital. For example, the TLcom investment supported Ilara in hiring a compliance lead to ensure that all equipment provided is in line with industry best practices.

Barnana

In 2019, BIO invested in EcoEnterprises Partners III. They invest in agribusiness, agroforestry, eco-tourism, and aquaculture companies in Latin American countries that have good relationships with local communities.

Barnana sells a range of organic banana and plantain-based snack products to wholesalers and leading retailers. In 2021, they acquired AgroApoyo, their Ecuadorian supplier, further integrating the value chain.

AgroApoyo directly supports over 60 communities by sourcing from nine agrosocial association, helping smallholder farmers to become organically certified.

Banco Solidario

Banco Solidario is a microfinance institution that targets un(der)served populations in Ecuador by providing both productive and consumption loans up to USD 20,000.

Solidario’s 53 agencies specifically focus on the vulnerable groups involved in commercial activities in urban and peri-urban areas.

In 2018, BIO provided a USD 10 million loan to finance Solidario’s microfinance portfolio. BIO's primary development goals identified for this investment include

- local economic growth by providing access to finance for microentrepreneurs and

- financial inclusion by providing access to finance for microenterprises with Banco Solidario’s good geographical coverage and range of accessible loan products.

BIO also supported Solidario with three TA projects between 2018-2022: the first one aimed at developing a credit management module for a financial education programme, the second helped the bank to develop digital outreach mechanisms, such as the mobile app and virtual assistant, and the third TA project targeted the measuring and benchmarking of Solidario’s gender equality practices through an Economic Dividends for Gender Equality radiography of the institution.

Client Protection Principles

The Smart Campaign was a global initiative launched in 2009 to make sure that financial services are delivered safely and responsibly to low-income clients. It developed the first global financial consumer protection standard, established a rigorous certification programme to validate practices by financial service providers, produced consumer protection research, and convened partners to effect change. Over the course of the programme more than 135 financial institutions, collectively serving more than 62 million low-income clients in 42 countries, were certified for adhering to the Smart Campaign’s Client Protection Standards. In 2020, the Smart Campaign was transformed into the “Client Protection Pathway” of Cerise and SPTF (Social Performance Task Force), that offers a roadmap for improved client protection practices. It also promotes Universal Standards for Social and Environmental Performance Management.

BIO requires MFIs to adopt the Client Protection Principles and the associated certification. To achieve this certification, the client is, amongst others, required to be transparent about the loan pricing and to adopt adequate measures to limit the risk of client over-indebtedness. In 2021, 11 out of the 24 microfinance institutions in BIO’s portfolio were Smart Campaign certified.

Cerise + SPTF

Over 20 years ago, Cerise+SPTF built the first version of the SPI tool in collaboration with purpose-driven organisations from the inclusive finance industry. In 2022, BIO helped them update it.

The upgraded version, SPI Online, offers resources and assessment tools for anyone with an interest in managing social and environmental performance—financial service providers, impact investors, regulators, auditors, and other types of social businesses. The platform contains the audit tools to help purpose-driven financial service providers as well as other social businesses track their progress related to their social and environmental objectives, and includes information and referrals for the other resources (technical, human, financial) necessary to that effort.

These tools are aligned with the third version of the Universal Standards for Social and Environmental Performance Management, and measure compliance with a range of leading international standards including the Sustainable Development Goals, the UN Global Compact, and standards developed by the ILO and OECD. The new platform is even more powerful as it allows standardised ESG measurement, which is the only way to prevent greenwashing and enable meaningful conversations on what works and does not work in ESG & Impact.

The data collected through the SPI online tool, which has more than 800 financial institutions users, enable the sector to analyse the state of the practices, to benchmark results, to understand gaps, and suggest improvements wherever necessary. The new tool encourages institutions to improve themselves. The work of impact investment is never completed, and BIO is proud to be part of it!

21 out of the 71 companies directly funded by BIO are in LDCs and 119 out of the 426 companies indirectly funded through funds