Affordable and clean energy

Investing in renewable energy and supporting its affordability is vital to ensure energy for all. Expanding infrastructure and upgrading technology encourages growth and helps the environment.

A lack of access to reliable energy is a major constraint to economic growth and development. At the same time, fossil-fuel energy production and consumption are major contributors to climate change. To reconcile these conflicting challenges, BIO invests in renewable energy and energy efficiency projects.

Promoting clean and affordable energy requires tremendous public and private investments in energy infrastructure and climate finance. Estimates exceed EUR 1 trillion annually up to 2030. Because the energy sector creates a lot of jobs and economic development, these enormous investments indirectly help to reach other SDGs as well.

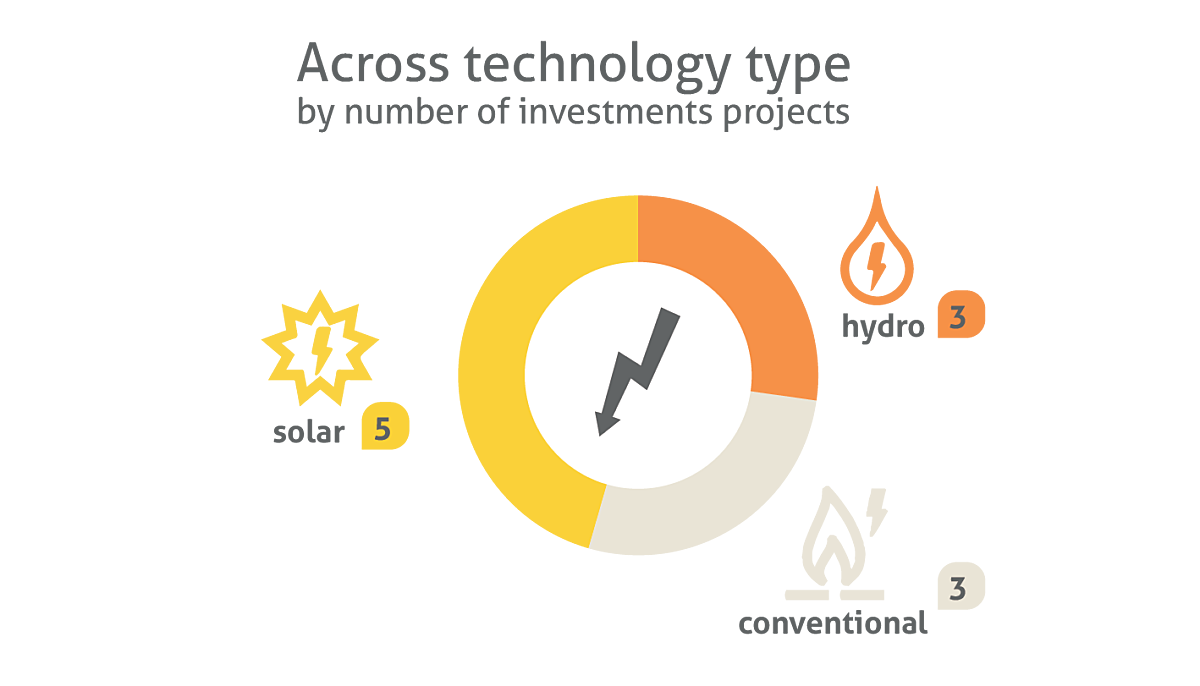

BIO has 11 direct investments in energy production facilities in its current portfolio, like e.g. the 20 MW photovoltaic power plant Ten Merina Ndakhar in Senegal. The total installed capacity of these projects is 1,075 MW. In 2022, they produced 4,705 GWh, an amount that could cover the energy needs of about 16.6 million people. Eight are renewable energy projects that include geothermal, hydro, wind, and solar energy. They represent 14% of the total energy produced by BIO's direct energy projects and avoid the emission of 210,000 tonnes of CO2 annually.

In addition to these direct investments, BIO has 87 indirect investments in energy-related projects. 84 of these were production facilities, funded through 11 investment funds that focus on energy and energy efficiency projects. The other projects deal with the transmission and distribution of electricity. Together they have an installed capacity of 9,351 MW. In 2022, they produced 1,196 GWh of electricity, sufficient to cover the consumption of 4.75 million people in the countries of production, and avoided the emission of 340,000 tonnes of CO2.

Increased availability, higher reliability, and lower prices for energy have large economy-wide effects as well, which include support to local jobs, added value, and opportunities for a modern and green industry.

BIO is fully committed to promoting renewable energy, but does not necessarily exclude investments in innovative gas projects, only when justified by the local context and in line with national long-term low emission development strategies. The three direct non-renewable energy projects produce reliable and cheaper electricity by using more efficient combined-cycle gas turbines. They are also cleaner than the locally available coal or diesel alternatives. However, in line with the EDFI Climate & Energy Statement, BIO will exclude all fossil fuel investments by 2030 at the latest.

Having access to clean, affordable and secure energy is a challenge in many of BIO’s countries of operation. When faced with a shortage of electricity, you can either increase your production or reduce your consumption. That is why BIO supports energy efficiency projects that reduce energy consumption by replacing obsolete equipment for newer, more efficient versions.

BIO has invested USD 10 M in equity in MSEF II, a green infrastructure private equity fund focusing on energy efficiency and renewable energy opportunities in Latin America and the Caribbean. They have, amongst others, invested in the Colanta dairy factory in Colombia, to help capture biogas at their lactose production plant to produce steam, replacing the use of steam produced on-site from a natural gas-based boiler.

In addition to the energy produced from fossil fuels or from renewable energy sources, there’s the energy locked in agricultural by-products or waste. By burning or digesting these under strictly controlled circumstances, we can recuperate energy that would otherwise have gone to waste. That is why BIO is also willing to invest in waste-to-energy facilities and will encourage its other clients to look for solutions for their by-products and waste streams.

In adherence to both national laws and applicable international standards, every power project funded by BIO must comply with stringent guidelines. To ensure the highest level of best practices, measures are instituted during both the construction and operational phases of these projects. This includes implementing an E&S impact assessment, prioritising local hiring practices, formulating community investment plans, and appointing dedicated personnel responsible for health and safety management, community liaison, and environmental studies and monitoring.

One of the issues frequently encountered in the energy sector is the uncertainty regarding the solar value chain.

Solar value chains

Over the past years, there have been alarming reports about forced labour concerning the Uyghur minority in China in the solar panel production. This raises many questions about how to deal with the risk of investing in projects involving solar panels.

BIO systematically requires its financial institution clients to identify and mitigate environmental and social risks in their portfolio, to ensure that the financial sector plays its role in pursuing the respect of environmental and social standards.

BIO strongly condemns any use of forced labour in its investment projects and in their supply and off-taker chains, and will communicate this position in all relevant relations with (potential) clients and other stakeholders. An example of such efforts can be seen in BIO’s recent follow-on investment in candi solar, a commercial and industrial solar (C&I) company active in South Africa and India. During the second due diligence, BIO was able to analyse the supply chain risk mapping exercises that the client has been performing to align with the ESAP requirements of BIO’s first investment. These allow the client (and its investors) to regularly check exposure to controversial suppliers and promote alternatives.

SUSI Asia Energy Transition Fund

In 2023, BIO invested USD 7 M in the SUSI Asia Energy Transition Fund (SAETF), a private equity infrastructure fund that invests in Southeast Asia. SAETF's investment strategy revolves around three pillars:

- Renewable Energy,

- Energy Efficiency, and

- Energy Storage.

Through this investment, BIO aims to address the increasing demand for electrification and electricity as a result of Southeast Asia's population growth. The region's energy demand is expected to double by 2040, with an annual growth rate of 4%. To manage this, most countries in Southeast Asia have set renewable energy targets and have adopted national renewable energy policies.

BIO's investment will reduce GHG emissions and directly contribute to climate mitigation. SAETF will track its impact through KPIs such as renewable energy generation and energy savings from the fund activities.