Financials

Balance sheet

The balance sheet total increased by € 20.1 M (+2%) from € 1,112 M to € 1,133 M.

Our net financial investments increased by € 43 M (+7 %) and our current assets decreased by € 23 M (-4%).

The increase on net financial investments is the consequence of the following elements :

- increase of the gross portfolio by € 35.3 M

- decrease of the stock of risk provision by € 7.8 M.

The treasury decreased by € 24.9 M mainly due to a higher level of disbursements compared to last year (+ 40 M).

Financial fixed assets, consisting almost exclusively of the investment portfolio, increased by 7% in 2023.

Shareholder equity increased by € 19.7 M under the cumulative effect of (i) the profit for the financial year of € 17.4 M and (ii) the net capital subsidies of € 2.3 M.

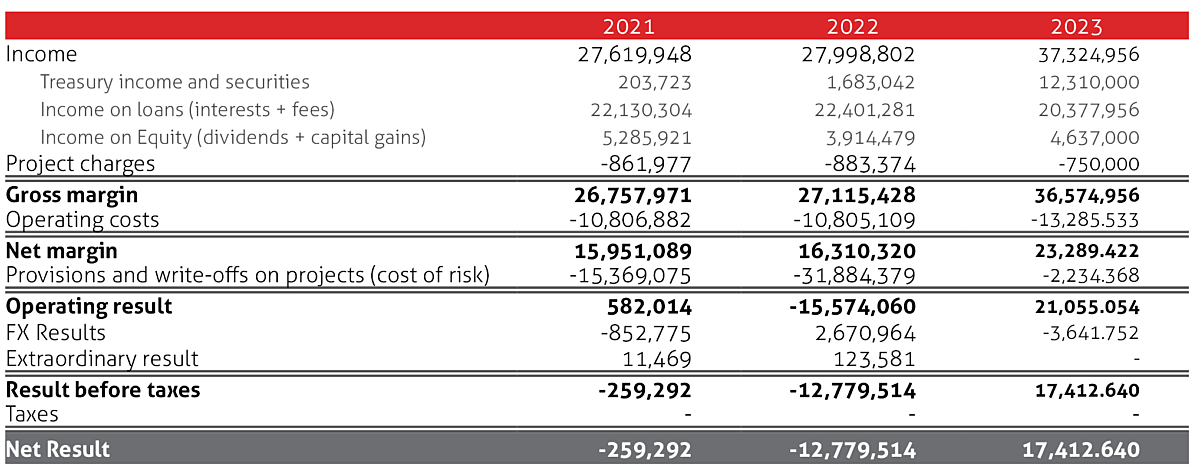

Income statement

After four years of contrasted financial performance, BIO becomes profitable again with a net income of € 17.4 M. This good performance is the result of a low materialization on risk (Cost of Risk at 0.3%), a good tenure of the loan and direct equity portfolios, and the important income generated on the placements of our treasury.

In addition, our portfolio achieved significant successes:

- Approval of new projects reached € 205 M, exceeding the objective by 5 M ;

- Net commitment reached € 1.079 M (+86 M) ;

- Net portfolio reached € 624 M (+ 7%) ;

- Gross portfolio increased by € 35 M to reach € 716 M (+ 5%).

BIO generated € 37.3 M of net revenues, which represents an increase of 11.2 M compared to the previous year.

The main drivers of this increase come from the treasury income generated by our treasury account held at the debt agency (+ € 10.6 M after withholding tax).

After deducting direct costs linked to projects (various commissions, travel expenses, bank transfer costs, etc.), the gross margin also increased by 35% and is aligned with the increase of the reported revenues.

Operating costs after deduction of the management fees increased by 2.5 M and reached € 13.3 M. This increase is significant but was expected considering the index on personal costs (11.08% index) and the inflation observed during the last two years.

The net margin is sufficient to cover the cost of risk and the operating result shows a positive balance of € 21 M.

Finally, we register a net foreign exchange loss of € 3.6 M.